Adjustable mortgage rates are still low. Should you get an ARM?

Adjustable-rate mortgages in 2022

As mortgage rates rise, homebuyers and mortgage refinancers are increasingly turning to adjustable-rate mortgages (ARMs).

Initial ARM rates are typically much lower than fixed mortgage rates, sometimes by a full percentage point or more. And that could help reduce your monthly payment or increase your home buying budget.

But adjustable-rate mortgages are risky, too. So does an ARM make sense for you? That depends on your long-term plans. Here’s what you should know.

In this article (Skip to…)

Today’s adjustable mortgage rates

Joel Kan, MBA’s associate vice president of economic and industry forecasting, recently wrote that “More borrowers continue to utilize ARMs to combat higher rates. The share of ARMs increased to 11 percent of overall loans and to 19 percent by dollar volume” during the week ending May 6, 2022.

So people are choosing adjustable-rate loans much more frequently than they used to. But why is that?

First, pretty much all mortgage rates shot up over the first quarter of 2022, making homeownership much more expensive. One way to get around that is to find a mortgage with a lower rate — such as an ARM.

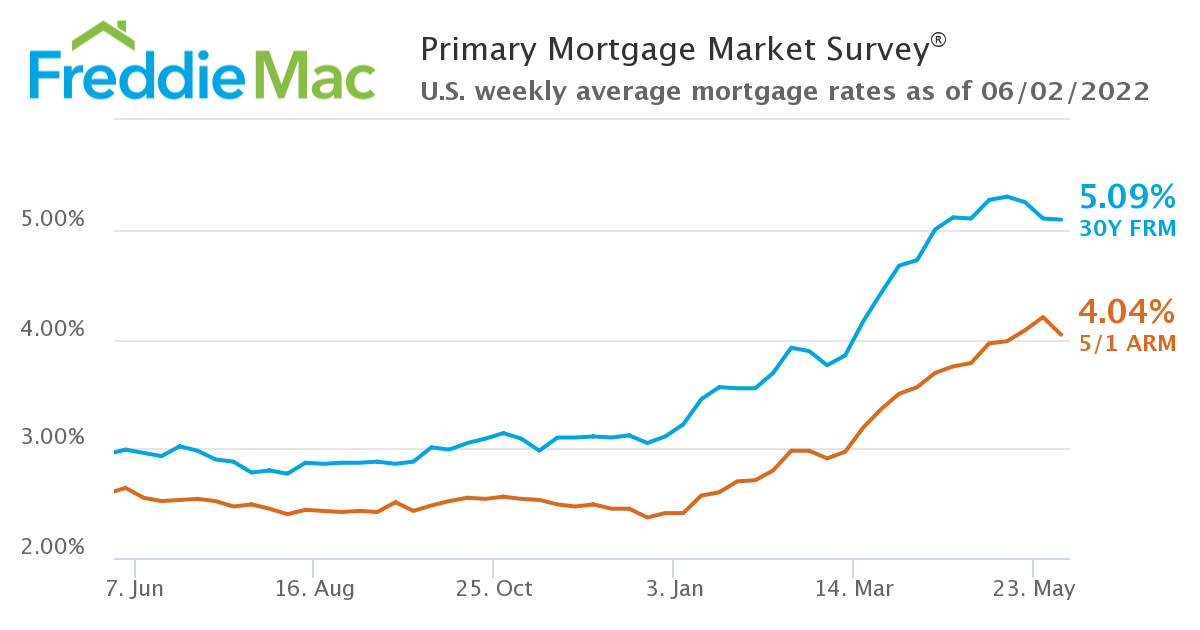

Second, the gap between FRM and ARM rates has grown significantly wider, making ARMs an even more attractive bargain. How wide is that gap? Take a look at this graph by Freddie Mac, and you’ll see how, by the end of May 2022, average 5/1 ARM rates were a full percentage point lower than 30-year fixed rates:

How ARM loans can help homebuyers

Having a lower ARM mortgage rate can help you in two ways. You can:

- Buy a home for the same price you planned and have a lower monthly mortgage payment

- Keep your monthly payment the same but afford a more expensive home

Lenders work out how much you can borrow based mainly on your debt-to-income ratio (DTI). And a lower interest rate, such as the intro rate on an ARM loan, gives you more purchasing power.

So you can receive real benefits when you get an ARM. That is, at least while the lower introductory rate lasts — which is typically for 5, 7, or 10 years. We explain how ARM rates work in more detail below.

ARM vs. FRM: Dollar-for-dollar comparison

How much might you save if you get an ARM compared to an FRM? We’ve come up with an example using our mortgage calculator. Of course, it’s unlikely your scenario will be the same as the one we imagined. So by all means, run your own numbers yourself.

We’re going to assume you want a mortgage of $342,960. That’s the median home price nationwide in the first quarter of 2022 ($428,700) minus a 20% down payment.

Based on the mortgage rates shown in the Freddie Mac graph (above), how big is the gap between monthly payments on ARMs and FRMs?

- 5/1 ARM: Monthly payment of $1,645 with a 4.04% mortgage rate*

- 30-Year FRM: Monthly payment of $1,860 with a 5.09% mortgage rate*

*Payment examples include loan principal and interest only. Your own interest rate and payment will be different.

In this example, choosing an ARM will save you $215 per month, at least for the 5-year fixed-rate period on your ARM. That’s $2,580 a year for the first five years — or $12,900 total. Given how inflation’s going, you might be glad for that additional money.

Affording more home with an ARM loan

Let’s rerun that scenario to see how much more you might be able to afford as your purchase price. This time, we’ve selected the “By monthly payment” tab on our calculator.

We set the target monthly payment at $1,860 and kept the down payment amount around $85,740 (the same as the example above). And we’re still using Freddie’s mortgage rates for June 2, 2022.

In this example, assuming the same monthly payment, you could borrow:

- 5/1 ARM: $450,600 with a 4.04% mortgage rate*

- 30-Year FRM: $429,000 with a 5.09% mortgage rate*

*Examples calculated using loan principal and interest only. Your own interest rate and home buying budget will be different.

So, with the same monthly payment, you might be able to borrow an extra $21,600 with an ARM. And that could be the difference between settling for second best and purchasing your perfect place.

How adjustable mortgage rates work

If you’re following interest rates, you’ll know they’ve gone up sharply in 2022. And you’re probably aware that — as of May 2022, when this was written — the Federal Reserve has penciled in several more significant hikes.

None of this should bother you if you opt for a fixed-rate mortgage. Whatever happens, your mortgage rate can’t change.

But things are very different if you choose an ARM. The clue’s in the name: “adjustable-rate mortgage.” Eventually, someone with an ARM could be hit by much higher rates and monthly payments.

So why would anyone choose an adjustable-rate loan at a time of sharply rising rates? For two reasons:

- You get to enjoy your low ARM rate for a fixed period of years. With an ARM, you can lock your low intro rate for a set time; typically 5, 7, or 10 years. If you don’t plan to keep your loan longer than that, an ARM could be a great deal

- The amount your interest rate can increase with an ARM is capped. Even when the locked period expires, most ARMs come with protections that moderate the possible damage

Read on for more detail on how ARM rates work and what to expect if you get this type of loan.

ARMs have an initial fixed-rate period

Almost all ARMs nowadays come with an initial period during which their rate is locked. You’ll see them advertised as x/y (e.g. 5/1 ARM). “X” is the number of years that rate can’t move. And “Y” is how often the rate can rise when that initial period ends. Y is nearly always 1, meaning the rate can move once every year.

For example, a 5/1 ARM — the most common type of ARM loan — has:

- A total loan term of 30 years

- A fixed interest rate for the first five years

- Potential for your rate to change once per year after the first 5 years

You can also find 3/1, 7/1, and 10/1 ARMs. These work the same as a 5/1 ARM except for the number of years your intro rate is fixed.

The amount your ARM rate can increase is capped

You need to talk to your lender and check your mortgage agreement to establish the protections your particular ARM provides. But federal regulator the Consumer Financial Protection Bureau (CFPB) provides a list of typical ones:

- Initial adjustment cap — How much the rate can rise when the initial fixed-rate period ends. The CFPB says: “It’s common for this cap to be either two or five percent — meaning that at the first rate change, the new rate can’t be more than two (or five) percentage points higher than the initial rate during the fixed-rate period”

- Subsequent adjustment cap — How much the rate can increase at each annual review. “This cap is most commonly two percent, meaning that the new rate can’t be more than two percentage points higher than the previous rate”

- Lifetime adjustment cap — How much the rate can increase in total over the entire lifetime of the mortgage. “This cap is most commonly five percent, meaning that the rate can never be five percentage points higher than the initial rate. However, some lenders may have a higher cap”

These caps can make a big difference to ARM borrowers who might otherwise face a very sharp increase in their mortgage rate and monthly payment. However, they only moderate those effects. And you need to be sure you’re in good enough financial shape to deal with any rate rises when they come.

What it means for you

All this can be important to home buyers choosing an ARM. Although a 2020 report from the National Association of Realtors says the average homeowner stays in their home for 13 years, many move much more frequently.

Suppose you’re almost sure you’ll move within the next seven years. Perhaps your job will require it or your family circumstances will change. What’s the point of paying extra to fix your rate for 30 years when a 7/1 ARM will protect you more than adequately?

Typically, the longer your initial, fixed-rate period lasts, the higher the rate you’ll pay. So a 7/1 ARM is probably more costly than a 5/1 ARM. But with any ARM intro rate, you’re likely to save money compared to a 30-year fixed-rate mortgage.

Who should get an ARM loan in 2022?

ARMs are not without risk. Mortgage rates are rising, and if your fixed-rate period expires, you could face significantly higher rates and mortgage payments in the coming years.

But for the right person, an adjustable-rate mortgage is a great tool.

The risks are small if you’re sure you’ll move home within five, seven, or 10 years — before the low intro rate expires. In that case, an ARM is a pretty safe bet. And you can benefit from the lower rates these mortgages bring.

If you’re planning to live in your home for much more than 10 years, however, an ARM poses greater dangers. If interest rates move as high as many expect, you could experience a real financial shock when your initial, fixed-rate period ends.

True, you could probably refinance to a fixed-rate mortgage at that point. But how high will loan rates for those be by then?

ARMs provide the right borrowers with great opportunities to make big savings or to buy nicer homes. But you should fully understand this product and your homeownership timeline before signing on.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.