VA cash-out refinance rates and guidelines for 2022

The VA cash-out refinance program

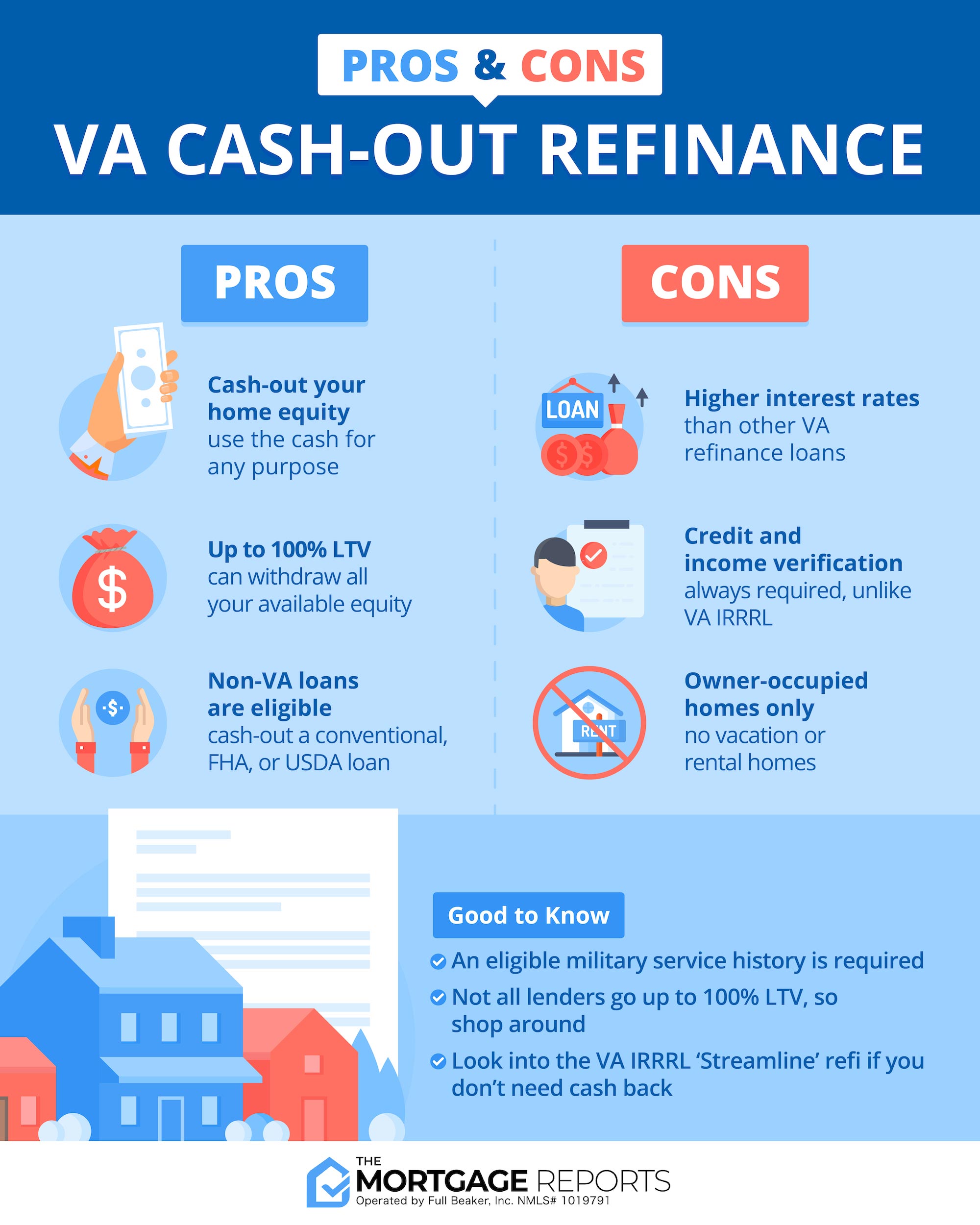

The VA cash-out refinance has exceptional benefits. It can help you access all the equity in your home. And veterans can use the VA cash-out refi even if their current mortgage is not a VA loan.

This refinance program can be used to convert any type of home loan into a VA mortgage with low rates, no mortgage insurance, and cash-back at closing.

In this article (Skip to…)

What is a VA cash-out refinance loan?

A VA cash-out refinance replaces your existing mortgage loan with a new VA home loan. The new loan typically has a bigger balance than your existing one. And that difference — the extra loan amount — is returned to you as cash-back at closing.

However, you’re not required to cash out home equity with this loan. You can also use a VA cash-out refinance to replace a non-VA loan with a VA loan and lower your mortgage interest rate.

Only veterans and current military service members can apply for a VA mortgage refinance.

VA cash-out refinance benefits

Unlike the VA Streamline Refinance (“IRRRL”) program, a VA cash-out refinance allows you to:

- Receive up to 100 percent of your equity as cash back at closing (but note, some lenders will only go to 90 percent)

- Refinance a non-VA loan (FHA or conventional loans, for example) into a VA loan

- Get rid of mortgage insurance if you currently have an FHA loan, USDA loan, or conventional loan with PMI

The VA cash-out loan allows up to a 100 percent loan-to-value ratio (LTV). That means you could get a loan that’s as large as the value of your home. Most other cash-out refinance options cap loan sizes at 80 percent LTV.

The cash back can be used to pay off other debt, pay for home improvements, invest in real estate, or for any other purpose.

As an example: Say an eligible homeowner owns a property worth $400,000. Their existing loan balance is $200,000. They could open a new VA cash-out loan for up to $400,000 and receive $200,000 cash back at closing, minus closing costs.

The VA cash-out refinance is an excellent tool allowing veterans to access large amounts of cash quickly.

VA cash-out refinance rates

The VA cash-out refinance gives veterans and active-duty service members a chance to refinance into a new loan with a lower interest rate and/or receive cash back.

VA interest rates are typically the lowest in the market thanks to backing from the Department of Veterans Affairs.

Today’s VA refinance rates start at just % (% APR), according to our lender network*. Compared to % (% APR) for a 30-year conventional loan, VA financing is a great deal.

| VA Loan Type | Today’s Average Rate |

| VA 30-year fixed-rate | % (% APR) |

| VA 15-year fixed-rate | % (% APR) |

*Average rates assume 0% down and a 740 credit score. See our full rate assumptions here.

VA cash-out refinance rates vs. ‘standard’ VA rates

One thing to keep in mind is that cash-out interest rates tend to be a little higher than no-cash-out mortgage rates.

That means cash-out refinance rates might be around 0.125% to 0.25% higher than VA loan rates you see advertised online.

However, this rule is not set in stone. Your own refinance rate depends on factors like your credit score and home equity — so if your personal finances are in a good place, you might get a great cash-out refinance deal.

And remember, you don’t have to refinance with your current mortgage lender. Use this to your advantage.

You can shop around with multiple VA-approved lenders to see which one can offer the lowest cash-out refinance rates for you.

VA cash-out refinance guidelines for 2022

To qualify for a VA cash-out refinance, you’ll need to meet minimum guidelines set by the Department of Veterans Affairs and by your individual lender. Expect to need:

- A credit score of at least 580-620 (varies by lender)

- Stable income and employment

- A debt-to-income ratio (DTI) under 41% in most cases

- Sufficient home equity if you plan to take cash out. Some lenders require you to leave at least 10% of your home equity untouched

You must also have an eligible military service history in order to use the VA loan program.

You’ll establish this by getting a Certificate of Eligibility (COE). Eligibility depends on the amount of time served, and the period in which you served.

You’re probably eligible for a VA loan if you’ve served:

- 90 days in wartime and are now separated

- 90 days and are still on active duty

- 181 days in peacetime and are now separated

- 2 years if enlisted in the post-Vietnam era

- 6 years in the National Guard or Reserves

- Or, if you are a surviving spouse

Eligibility can also be established for other service members with a non-dishonorable discharge.

VA-approved lenders can check eligibility, often within minutes, via direct online requests to the Department of Veterans Affairs.

If you have any U.S. military experience whatsoever, it’s worth checking your eligibility for a VA loan. Remember, you can use the VA cash-out refinance to get a new loan, even if your current mortgage is not backed by the VA.

The VA cash-out refinance process

The VA cash-out refinance process will be similar to the mortgage process you went through when you bought your home.

Homeowners who want a VA cash-out loan will:

- Choose a VA lender – Compare at least three to five lenders to make sure you’re getting the best deal

- Get your certificate of Eligibility (COE) – Your loan officer can easily pull this for you in a few minutes

- Complete your loan application – You’ll submit supporting documents like bank statements, pay stubs, and W2s

- Get a new home appraisal – The lender will order an appraisal on your behalf. The new appraised value determines how much equity you have available to withdraw

- Go through underwriting – This is mostly a waiting game while the lender verifies your financials. Be sure to respond to any document requests quickly

- Close the loan – On closing day, you’ll sign your final loan documents and pay closing costs

Keep in mind, a VA cash-out refi requires full underwriting.

That means it will require more time and paperwork than the VA Interest Rate Reduction Refinance Loan (IRRRL), which has reduced paperwork.

If you use the VA cash-out refinance, be prepared to show:

- Income documents (pay stubs and/or W2s)

- Bank statements

- Potentially, tax returns

- A credit report and credit score

- A new home appraisal

- Your current mortgage balance

You might also be asked for an itemized list of debts to be paid off with loan proceeds, if you plan to use your cash-out funds for debt consolidation.

VA cash-out refinance loan limits

As of January 1, 2020, there are no longer any VA loan limits. Qualified borrowers can finance 100 percent of their home’s value with no down payment. That applies to both VA purchase and refinance loans.

So, what does “no limit” mean for your cash-out refinance?

It means you could refinance the home for 100 percent of its value and take all your home equity out as cash.

Imagine you have a VA loan on a home worth $700,000. In 2022, you still owe $500,000 on the home.

Under the new rule, you could use a VA cash-out refinance to get a new loan for $700,000 on that home — allowing you to take the full $200,000 in cash, less closing costs.

That would have been impossible pre-2020 when VA loan limits were more or less equal to conforming loan limits.

This doesn’t mean you’re guaranteed a loan that’s 100 percent of your home value. You’ll still have to qualify by meeting your lender’s minimum credit score and DTI guidelines.

VA cash-out lenders

Choosing a lender for your VA cash-out refinance is a crucial part of the process. That’s because only some lenders allow you to take full advantage of your VA cash-out benefits.

For example, the Department of Veterans Affairs allows up to 100% financing. So you can technically withdraw all your home equity using a VA cash-out loan.

But not all lenders follow VA’s rules to a tee. Many only allow up to 90% financing — or even lower.

Not all VA lenders allow you to take full advantage of your VA cash-out benefits. So be sure to shop around.

This is especially important for homeowners who made a small down payment, or haven’t owned their homes very long. If you have minimal home equity to begin with, you need a VA cash-out lender that will be flexible about your loan-to-value ratio in order to qualify.

Your mortgage lender affects your interest rates, too.

Remember that VA cash-out refinance rates are a little higher than no-cash-out VA refinance rates. So you want to be extra thorough when shopping for a lender that will give you a good deal.

For a good starting place, see our review of The Best VA Lenders. Or, you can get matched with a lender directly using the link below.

Best uses for a VA cash-out refinance

Cash-back isn’t the only reason to open a VA “cash-out” loan. In fact, the name for this loan is a bit misleading.

The VA cash-out can pay off and refinance any loan type, even if the applicant does not plan to receive cash at closing.

The veteran can:

- Pay off a non-VA loan

- Get cash at closing, or

- Do both simultaneously

The VA IRRRL, by comparison, is a VA-to-VA loan program only. You cannot use the IRRRL program if your current loan is FHA or any other type.

1. Use a VA cash-out refi to get rid of mortgage insurance

One of the biggest benefits of converting a non-VA loan to a VA loan is that VA loans don’t require ongoing mortgage insurance payments.

That means veterans can reduce their homeownership costs by paying off an FHA loan and canceling their FHA MIP.

Likewise, VA-eligible homeowners can refinance out of a conventional loan that requires private mortgage insurance (PMI).

Here’s an example.

A veteran purchased a home with an FHA loan in 2016. The outstanding loan amount is $250,000. The FHA mortgage insurance costs $175 per month.

The veteran can use a VA cash-out loan to refinance the FHA mortgage into a VA one — even if they do not want to take additional cash out. The veteran now has a no-mortgage-insurance loan and, potentially, a new lower rate.

2. Refinance out of a more expensive loan program

VA financing can be used to pay off any loan with unfavorable terms:

- An Alt-A loan with a high interest rate

- Interest-only loans

- Adjustable-rate mortgages

- First and second mortgage combo “piggyback” loans

- Standalone second mortgages

- Any loan that requires mortgage insurance

- Construction liens

- Judgment or tax liens

- Bridge loans

In short, you can refinance any home loan into a VA loan with more favorable terms — regardless of the type of loan it is.

To get a better idea about your potential savings, you can use a refinance calculator.

3. Refinance a high-LTV mortgage into a lower rate

The housing downturn happened more than a decade ago, but some veteran homeowners are still feeling the effects.

The good news (for veterans, anyway) is that the VA cash-out refinance can be opened for up to 100 percent of the home’s value. The VA program can refinance a loan to a lower rate even if the homeowner is nearly underwater.

For instance, say a veteran got a non-VA loan for $200,000 at an interest rate of 6.5%.

Home values dropped, and they were unable to refinance into a conventional loan.

As an eligible veteran, they could open a VA cash-out loan for 100 percent of the home’s current value, paying off the high-interest loan, and reducing their monthly payment.

4. Consolidate mortgages and other debt with a VA cash-out refi

Borrowers can take cash out of their homes at the same time they combine first and second mortgages into a single low-cost VA loan. That’s true even if the current mortgages aren’t VA loans.

For example, let’s say a veteran purchased a home with an FHA loan, then later got a second mortgage from a local bank.

The VA-eligible homeowner can now pay off both loans, eliminate mortgage insurance, and consolidate the two loans into one.

If there is cash left over, the homeowner can cover medical bills, handle a family emergency, start a business, pay off high-interest short-term loans and credit cards, or use the cash for almost any other purpose.

VA cash-out refinance FAQ

Below are the most commonly asked questions about the VA cash-out refinance program.

Yes. As long as you are eligible for a VA mortgage and have enough home equity, VA allows cash-out refinancing to access your home’s cash value. You can also use the VA cash-out loan to switch from a non-VA mortgage into a VA loan with or without cash back.

A VA cash-out refinance replaces your existing VA mortgage with a new VA loan. If you want cash-back at closing, you can take out the new loan for a larger amount than your existing loan, and receive the difference in cash. However, the VA cash-out refinance does not require you to receive cash-back.

A VA cash-out refinance is a good idea for two types of people. Either you want to refinance your current VA mortgage and get cash back at closing, or you have a non-VA mortgage that you want to refinance into a VA loan. For current VA loan holders who do not need cash back at closing, the VA Streamline Refinance is usually a better choice.

You can obtain a VA cash-out loan for up to 100 percent LTV, plus the VA funding fee. For instance, if a veteran’s home appraises at $100,000 and they pay a 2.3 percent funding fee, their total loan amount can be up to $102,300. Veterans and service members can also add the cost of energy-efficient improvements to the total, even if that raises the loan amount above the full value of the home.

A Type 2 VA cash-out refinance means your new loan amount is larger than the loan being refinanced; this is a loan where you actually receive cash-back. A Type 1 VA cash-out refinance means your new loan amount is equal to or less than your existing loan; this might be the case if you are refinancing a non-VA mortgage to a VA mortgage and do not want cash back at closing.

Upfront closing costs for refinancing are typically 2 to 5 percent of the loan amount. VA loans are unique because the lender’s origination fee can’t be more than 1 percent of the loan amount. Most homeowners use some of their cash-back to pay closing costs so they don’t have to pay out of pocket.

VA cash-out refinancing usually takes about as long as a standard mortgage: 40 to 55 days on average. That’s because a VA cash-out refinance requires full underwriting — meaning the lender has to take all the same steps it would for a home purchase loan, including a home appraisal, credit report, and full documentation. By comparison, an IRRRL requires fewer documents and can often close in less than a month.

For first-time use, the VA funding fee is equal to 2.3 percent of the loan amount. That includes non-VA loan holders using the cash-out refinance to switch into a VA loan. If you’ve used your VA home loan benefit before, the funding fee will be 3.6 percent.

A VA Streamline Refinance usually doesn’t require an appraisal — or bank statements, pay stubs, W2s, or tax returns. However, it is available only if you have a VA loan currently and you don’t need cash at closing. VA cash-out is the only VA refinance program that allows you to cash out your home’s equity and refinance out of any loan type.

Yes. These loans are available up to 100 percent of the home’s current appraised value. To establish the current home value, a new appraisal is required.

No. The property on which the VA loan is used must be the borrower’s primary residence.

Yes. A VA cash-out loan can pay off and refinance any loan type, including an FHA, USDA or conventional loan with a fixed or adjustable rate. You can use this refi program to get out of a loan with a high rate or one that has mortgage insurance.

Yes. A VA cash-out refinance can pay off any loan, provided you are VA-eligible and meet cash-out mortgage requirements.

There are no restrictions on what you use the cash for. The VA lending handbook says cash can be used for “any purpose acceptable to the lender.” That said, some uses for your cash-out refinance are wiser than others. Using cash-out funds for a purpose like debt consolidation, for example, can be very smart and save you a lot of money in the long run.

Texas imposes strict home equity loan laws that limit cash-out financing to 80 percent loan-to-value. Texas law supersedes the VA’s 100 percent financing guideline for cash-out loans. If you were turned down, it may have been because you had less than 20 percent equity in your home.

VA mortgage rates are typically lower than those for a similar conventional or FHA refinance. But remember, rates always depend on the borrower. If someone wants to get a VA loan but has very high debts and low credit, their rate will likely be higher than current average VA rates.

Yes, but several other factors also affect the amount of your mortgage payments. For example, refinancing to a shorter loan term could increase your monthly mortgage payments. But you’d be paying less interest over the life of the loan. If you’re refinancing an existing VA loan simply to reduce your mortgage payments, consider the IRRRL Streamline loan first.

Yes, the VA allows homebuyers and refinancers to buy down their interest rate with discount points. But buying points makes sense only if you stay in the mortgage long enough. If you sell or refinance again too soon you won’t recoup the upfront cost of the points.

Lenders can offer low-cost loans through the VA lending program because the Department of Veterans Affairs provides a guaranty for part of your loan’s value. The lender would be compensated if you couldn’t repay the loan. Conventional loans don’t offer this guaranty, and thus need to charge expensive private mortgage insurance (PMI) to protect lenders from financial loss.

If you have an eligible service history and decent credit, there’s a good chance you qualify for the VA cash-out program. Check with a mortgage lender to determine your eligibility and see how much cash you can take out.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.