How to Get Your Outstanding Invoices Paid

In

this

article,

we

cover:

As

a

business

owner,

it’s

frustrating

to

have

customers

tie

up

your

capital.

You’ve

provided

goods

or

services,

fulfilled

your

end

of

the

bargain,

and

now

you’re

left

waiting

for

payment

on

outstanding

invoices.

The

reality

is

that

late

payments

can

create

significant

cash

flow

issues,

affecting

your

ability

to

meet

expenses

and

invest

in

the

growth

of

your

business.

This

is

a

common

challenge,

with

54%

of

small

businesses

reporting

being

affected

by

late

payments,

according

to

LinkedIn.

If

your

business

is

one

of

the

statistics,

don’t

worry.

There

are

practical

strategies

to

help

you

navigate

this

challenge.

In

this

article,

we

explore

strategies

to

help

ensure

your

customers

pay

the

outstanding

invoices

they

owe.

What

is

an

outstanding

invoice?

An

outstanding

invoice

is

a

bill

that

has

been

delivered

to

a

customer

but

has

not

yet

been

paid

or

reached

its

payment

deadline.

It

represents

money

owed

by

the

customer

to

the

vendor

or

service

provider

by

a

certain

date.

If

that

due

date

comes

and

goes

without

the

customer

paying,

the

outstanding

invoice

becomes

a

past

due

one.

Past

Due

vs.

Outstanding

Invoices

|

Outstanding Invoices |

Both |

Past Due Invoices |

|---|---|---|

|

Due date has not yet passed |

Invoice has been delivered to customer |

Due date has passed |

|

Customer has not paid |

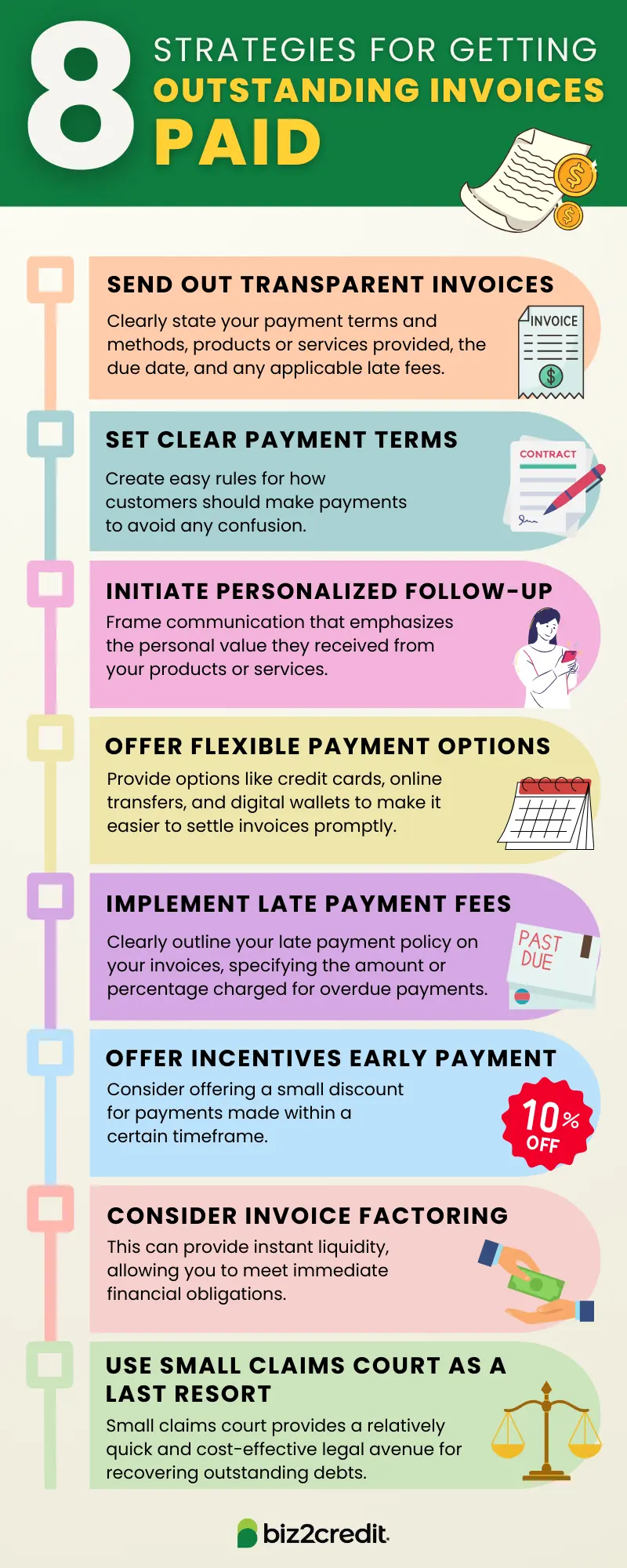

Strategies

for

Getting

Outstanding

Invoices

Paid

1.

Send

Out

Clear

and

Transparent

Invoices

The

first

step

in

ensuring

timely

payments

is

to

establish

a

clear

and

transparent

invoicing

process.

Your

invoices

should

be

easy

to

understand,

outlining

the

products

or

services

provided,

the

due

date,

and

any

applicable

late

fees.

Clearly

state

your

payment

terms

and

methods,

making

it

convenient

for

your

clients

to

settle

their

bills.

Use

accounting

software

that

allows

you

to

generate

professional-looking

invoices

with

ease.

Modern

platforms

often

offer

features

like

automatic

reminders,

helping

you

stay

on

top

of

overdue

payments

without

the

need

for

constant

manual

follow-ups.

You’ll

also

want

to

make

sure

that

all

of

the

necessary

information

pertaining

to

your

business

is

included.

For

example,

you

may

need

to

include

your

EIN,

along

with

your

company

name,

address,

and

contact

information.

2.

Set

Clear

Payment

Terms

Create

easy

rules

for

how

customers

should

make

payments

to

avoid

any

confusion.

Clarity

in

your

invoicing

process

also

helps

in

avoiding

misunderstandings

and

delays.

When

it

comes

to

payment

deadlines,

clearly

communicate

your

expectations

up

front,

and

make

sure

it

is

prominently

stated

on

your

invoices.

3.

Initiate

Personalized

Follow-Up

When

an

invoice

becomes

overdue,

don’t

be

afraid

to

begin

personalized

follow-up

communication.

Instead

of

relying

solely

on

automated

reminders,

take

the

time

to

reach

out

to

your

clients

personally.

A

friendly

and

professional

phone

call

or

email

can

go

a

long

way

in

reminding

them

of

their

outstanding

payment.

Frame

your

communication

in

a

way

that

emphasizes

the

value

they

received

from

your

products

or

services

and

expresses

gratitude

for

their

business.

Discuss

any

issues

they

might

be

facing

that

could

be

causing

the

delay,

as

well

as

a

possible

date

of

settlement.

4.

Offer

Flexible

Payment

Options

Provide

flexible

payment

options

like

credit

cards,

online

transfers,

and

digital

wallets

to

make

it

easier

for

clients

to

settle

their

invoices

promptly.

In

addition,

consider

implementing

installment

plans

for

larger

invoices

so

clients

can

spread

the

cost

over

several

payments.

This

not

only

eases

their

financial

burden

but

also

increases

the

likelihood

of

receiving

timely

payments.

5.

Implement

Late

Payment

Fees

While

it’s

important

to

maintain

positive

relationships

with

your

clients,

implementing

late

payment

fees

can

act

as

a

deterrent

for

future

delays.

Clearly

outline

your

late

payment

policy

on

your

invoices,

specifying

the

amount

or

percentage

charged

for

overdue

payments.

Be

consistent

in

enforcing

late

fees,

as

this

demonstrates

your

commitment

to

timely

payments.

However,

it’s

advisable

to

use

this

approach

judiciously,

reserving

it

for

cases

where

the

delay

is

significant

and

persistent.

6.

Offer

Incentives

for

Early

Payment

Consider

offering

a

small

discount

for

payments

made

within

a

certain

timeframe,

such

as

a

2%

discount

for

payments

made

within

10

days.

While

this

may

reduce

your

profit

margin

slightly,

it

can

help

improve

your

cash

flow

and

strengthen

your

client

relationships

in

the

long

run.

Another

advantage

of

this

incentive

is

that

it

encourages

your

customers

to

keep

up

with

the

habit

of

paying

early.

7.

Consider

Invoice

Factoring

If

late

payments

are

becoming

a

chronic

issue

and

affecting

your

business’s

financial

stability,

exploring

invoice

factoring

might

be

a

viable

solution.

Invoice

factoring

involves

selling

your

unpaid

invoices

to

a

third

party

(factor)

at

a

discount

in

exchange

for

immediate

cash.

While

this

option

means

you

won’t

receive

the

full

value

of

the

invoice,

it

provides

instant

liquidity,

allowing

you

to

meet

immediate

financial

obligations.

Before

pursuing

invoice

factoring,

carefully

assess

the

associated

costs

and

terms

to

ensure

they

align

with

your

business

goals.

8.

Use

Small

Claims

Court

as

a

Last

Resort

If

all

else

fails

and

your

efforts

to

secure

payment

prove

fruitless,

consider

small

claims

court

as

a

last

resort.

Small

claims

court

provides

a

relatively

quick

and

cost-effective

legal

avenue

for

recovering

outstanding

debts.

While

considering

this

option,

assess

the

feasibility

and

potential

costs

before

pursuing

legal

action.

Get

Your

Outstanding

Invoices

Paid

Promptly

After

all

is

said

and

done,

you

want

to

be

sure

your

capital

is

not

locked

up

longer

than

necessary.

If

you

implement

clear

invoicing

processes

and

maintain

open

communication

with

your

clients,

you

can

create

an

environment

that

encourages

timely

payments.

To

read

more

insightful

articles

on

business

and

financial

growth,

head

to

our

blog

section.

Or

read

success

stories

from

business

owners

like

you

by

clicking

here.

And

if

you

prefer

a

personal

consultation

to

discuss

suitable

financing

to

solve

your

business

problems,

you

can

contact

us

directly.

Your

business

growth

and

prosperity

are

our

priority.

Comments are closed.