How Employers Can Help Employees Reach Their Student Loan Repayment Goals – And Why That Matters

The latest extension of the COVID-19-related pause on federal college loan repayments has given employers another important chance to help their employees prepare for what may be a big shock to their budgets.

Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, federal college loan payments were suspended, and interest rates were set to 0%. The most recent pause extension was scheduled to expire at the end of January 2022. But in late December, the Biden Administration announced that the pause would be extended to May 1, 2022.

That’s good news for the nearly 43 million people who owe some type of federal student loan debt. It’s also good news for employers, many of which were developing or enhancing student debt support programs in anticipation of the original deadline. This latest extension gives employers a new window of opportunity to help employees prepare for repayment and to make sure the transition goes smoothly.

Why Focus on Student Loan Repayment?

An employer student loan program can help address a major source of financial stress within a workforce and, in turn, boost both employee engagement and productivity.

The payment restart, delayed as it has been, is daunting for many. More than two-thirds of borrowers said it would be difficult to make payments again if they resumed the next month, according to a Spring 2021 Pew Charitable Trusts survey of 2,806 respondents. Employees with budgets already strained by the pandemic may sacrifice key elements of financial wellness, like retirement contributions and emergency savings, in order to resume student loan payments.

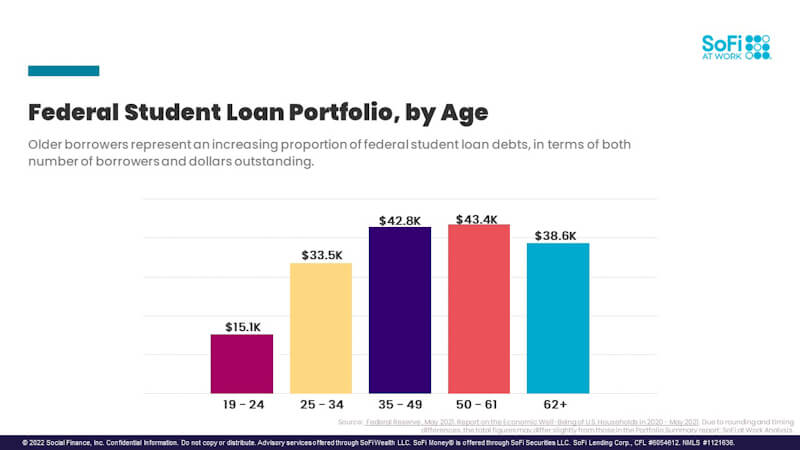

We often think of student debt as a recent college grad issue, but more employees than you might imagine are burdened by student loans. Over 68 percent of people with student debt are between ages 25 and 50, according to EducationData.org . Indeed, those aged 35 to 48 carry an average outstanding debt of $42,800 per borrower.

Offering student loan repayment support as part of an overall financial wellness program also gives your organization an edge in retaining and recruiting a large portion of the workforce with student loan debt. In the midst of the Great Resignation, or what now looks more like the Great Reshuffling, it’s more important than ever for companies to stand out in the marketplace.

How Employers Can Help

At SoFi at Work, we encourage a holistic approach to student loan repayment. That includes helping employees make the most of the recent repayment extension, as well as encouraging them to develop a better understanding of how student loan repayment fits into their current budget and long-term financial goals.

Consider these four simple-but-effective action points to help your employees meet their repayment goals.

1. Provide a Financial Health Assessment Tool

One of the best ways to determine what you can do to promote financial wellness among your employees is to ask them what they need. If you haven’t already, you may want to design an online financial wellness assessment survey that analyzes four pillars of financial security — spending, saving, debt, and future goals — and encourage all employees to participate.

An effective self-assessment survey enables you to take a measure of the financial well-being of your workforce and lets you see firsthand the financial struggles your employees may be going through. In addition, when employees take a thoughtful, well-written survey, they’re not just inputting information; they’re also thinking through their own financial wellness strategy. Many online assessment tools, such as SoFi at Work’s, provide recommendations on the next steps based on how people feel about their current situation.

Whatever assessment tool you choose to use, be sure that student debt and the end of the payment pause are part of the survey.

Encourage a Step Ladder Direct Deposit Approach to Repayment

With the latest extension, employees have more time to get ready for student loan repayment. One way to help them capitalize on it is to offer a gradual, step-ladder return to repayments starting now. This can help ease the shock of repayment and also ensure that employees have their monthly payment when payments resume.

How it works: First, HR professionals can advise employees to take stock of their student debt and calculate what their monthly payment will be starting in May. Next, the employee can set up a separate account, such as SoFi at Work’s Emergency Vault, specifically earmarked for student loan repayment. With the account in place, they can then set up a tiered direct deposit (DD) that starts with a small DD per pay period (ppp), and works up to the full amount needed for the loan payments.

Here’s an example of how to calculate a graduated DD using an employee who has a $500 monthly loan payment, 3 months to prepare, and gets paid bimonthly:

Month 1: Take out 10% of the expected student loan monthly payment, or $50 ppp. The amount in the dedicated account will be $100 at the end of the month.

Month 2: Take out 20% of the expected payment, or $100 ppp. The amount in the dedicated account will be $300 (ignoring any interest accrued) at the end of month 2.

Month 3: Take out 30% of the expected payment, or $150 ppp. The amount in the dedicated account will be $600 (ignoring any accrued interest) at the end of month 3, enough to cover the first payment and some leftover for the next payment.

Month 4: Take out 50% of the payment, or $250 ppp. This gives them the amount they need to cover their student loan payments moving forward.

The graphic below shows how this works if an employee starts in January, but it’s equally effective if they start in February. They can also start later by adjusting the DD amount. By promoting this strategy, HR professionals can help employees gradually adjust to having less disposable income and avoid the financial “cliff” of repayment.

If employers want to go further, they can also establish a short-term contribution program in which they match the employee’s contribution (see below for more on this) to add to and promote this strategy.

Help Employees Understand the Importance of a Good Credit Score

As employees evaluate their student loan situation in the face of the repayment deadline, many may determine that financing large student loan debt may help ease the month-to-month strain. In the meantime, employers can counsel workers on the importance of a good credit score when applying for student loan refinancing and other debt.

This is especially critical in light of the Federal Reserve’s recent indications that it will raise interest rates in the near future, a move that would make it more costly to borrow and a good credit score increasingly important.

Consider giving your employees tools to check their credit scores, as well as information on how to improve them, such as offering credit counseling or credit-building workshops. Establishing good credit is an important component of any financial wellness program that can help employees improve their financial circumstances, whether that’s making student loan payments more affordable, qualifying for a mortgage, or getting better rates and terms on credit cards and other types of loans.

Let Employees Know They Can Use a 529 to Pay Down Debt

The SECURE Act (Setting Every Community Up for Retirement Enhancement) passed in December 2019, includes an additional benefit to help with student loans. You can now withdraw $10,000 tax-free from a 529 plan to make student loan payments.

Unfortunately, many borrowers are unaware of this change or the fact that students and former students are allowed to set up a 529 for themselves. By opening this type of account, employees can save for loan repayment (as well as tuition, of course) and receive all the tax benefits of a 529. Any effort employers can make to educate their workforces about this important change can enhance their overall student debt and financial wellness programs.

To make it easier for employees to save in state-sponsored 529 college savings plans, you may want to offer a 529 payroll deduction program if you don’t already.

New Student Loan Repayment Benefit Rules

The CARES Act did more than offer the repayment pause. It also included a provision that encourages employers to offer student loan repayment benefits. Employers can now provide up to $5,250 annually for an employee’s student loan repayment through 2025. These payments can be made directly to the employee or to the student loan carrier.

Employees won’t pay income tax on contributions made by their employers toward educational assistance programs, yet the employer also gets a payroll tax exclusion on these funds. This change has encouraged many firms to start offering student loan repayment benefits.

The Takeaway

A large share of the U.S. workforce has student loan debt and, after a break of over two years, payments on federal student loans will resume on May 1, 2022. As a result, many workers may struggle to resume these payments.

A financial wellness program that includes student loan support is an opportunity for employers to reduce employee stress, improve retention and engagement, and set themselves apart in the marketplace.

SoFi at Work offers an array of tools that can help your employees manage student loan repayment, including financial health assessment surveys, set-and-forget savings programs, and student debt refinancing and repayment platforms.

Photo credit: iStock/skynesher

SoFi at Work is offered by Social Finance Inc. SoFi loans are offered by SoFi Lending Corp. or an Affiliate (dba SoFi), licensed by the Department of Financial Protection and Innovation under the California Financing Law, license #6054612; NMLS #1121636 www.nmlsconsumeraccess.org . The Student Debt Navigator tool and 529 Savings and Selection tool are provided by SoFi Wealth, LLC, an SEC Registered Investment Advisor. For additional product-specific legal and licensing information, see https://sofi.com/legal.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SoFi Money®

SoFi Money is a cash management account, which is a brokerage product, offered by SoFi Securities LLC, member FINRA / SIPC .

Neither SoFi nor its affiliates are a bank. SoFi Money Debit Card issued by The Bancorp Bank.

SoFi has partnered with Allpoint to provide consumers with ATM access at any of the 55,000+ ATMs within the Allpoint network. Consumers will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

SOBD0122001

Comments are closed.