What is a Mortgage Credit Certificate and how does it work?

What is a mortgage credit certificate?

If you’re buying a home with help from your state or local government, you may be offered a mortgage credit certificate (MCC). If you are, take advantage of the offer.

A mortgage credit certificate could give you a worthwhile tax break. And, unlike other mortgage tax cuts, you can take advantage of an MCC even if you’re taking the standard deduction rather than itemizing your taxes. That could mean direct savings on your federal tax bill.

The Mortgage Reports is not a tax site. This information is for general guidance only. Consult with a tax professional about your specific situation.

In this article (Skip to…)

How mortgage credit certificates work

A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills. The amount you could save on your taxes with an MCC varies by state, but the IRS caps the maximum mortgage credit certificate at $2,000 per year. MCCs are typically geared toward lower–income, first–time home buyers, but rules vary by program.

MCCs are typically offered in conjunction with state–run mortgage programs, and you may be eligible for one if you’re getting a loan through your local Housing Finance Authority (HFA).

When you have a mortgage credit certificate you can submit an IRS form 8396 each tax year for as long as your certificate is valid. And you can do that even if you don’t itemize your deductions and instead take the standard deduction. Check out the guidance on the IRS’s website.

Your MCC is tied to your mortgage. So it will stop being valid if you refinance, move out, or sell the home.

MCC benefits

Unlike mortgage tax deductions, which may reduce your taxable income – and only if you itemize your taxes – a mortgage credit certificate is a dollar–for–dollar reduction in your tax bill. And you don’t need to itemize your deductions to take advantage of it. So homeowners who qualify for the maximum MCC amount could save up to $2,000 per year on their taxes.

MCC drawbacks

It is possible for the IRS to come after those with mortgage credit certificates for recapture tax. But this happens very rarely and only when ALL THREE of the following circumstances apply at once:

- You sell the home within nine years of purchase

- You’re earning a whole lot more than you were when you bought the place

- You’ve made a gain from selling the home

The FDIC says, “The maximum amount of recapture, which is payable on the sale of the home, is 6.25 percent of the original principal balance of the loan or 50 percent of the gain on the sale of the home, whichever is less.”

There are two other potential drawbacks:

- An MCC can only be used to reduce your tax bill; the IRS will not issue you the MCC amount as a refund. That’s because the annual value of the certificate is capped at your tax liability for that year. If you’re paying next to nothing to the IRS, your MCC tax benefit will be next to nothing. That could be an issue if you get a child tax credit and have very low income

- There’s usually an upfront fee for issuing an MCC. Check how much that is with your HFA or a lender on your HFA’s list

An MCC may or may not be the best option for you. Keep in mind that there are plenty of other down payment assistance programs in every state. And one of those might serve you better. So explore all your options with a loan advisor before deciding which program to use.

How to get a mortgage credit certificate

You may be able to get a mortgage credit certificate if you receive home buying assistance from your state, city, or county housing finance agency. MCCs are only issued by HFAs.

But not all agencies offer them. According to the National Council of State Housing Agencies, “28 State HFAs issued 22,298 MCCs in 2019.” If your state’s HFA isn’t among those that issue MCCs, you could see if one administered by your city or county does.

You can use this state HFA directory to find your local agency. And search online for “homebuyer assistance” plus your city or county’s name.

Who is eligible for an MCC?

Each housing finance agency sets its own eligibility rules. So you should check with your local HFA or an HFA–approved lender to learn whether you’re eligible.

That said, many HFAs have similar criteria. They often prefer to help lower–income, first–time home buyers who meet the following general guidelines:

- First-time homebuyer: Often defined as not having owned a home in the previous three years. Sometimes waived for those buying in an officially designated “target area”

- Moderate or modest income: Eligibility is often tied to the “area median income” (AMI) for the place where you’re buying. Some HFAs allow incomes somewhat above the AMI. Use this AMI lookup tool to find yours

- Home price within local purchase price caps: You typically must buy a home with a moderate or modest price compared to the median for the area where you’re purchasing

- Primary residence: You must buy a home you’ll live in yourself, not an investment property nor a vacation home

- Approved lender: You must choose a participating mortgage lender from a list provided by the HFA

- Homebuyer education: You often must complete a homebuyer education course to qualify for HFA programs. These may be provided online and are often free

To repeat: Each HFA sets its own rules. And yours may have different guidelines from the ones listed above. But those are common.

Mortgage credit certificates typically come within a package of homebuyer assistance. And such packages often include special mortgages with competitive rates and down payment assistance programs.

Mortgage credit certificate example

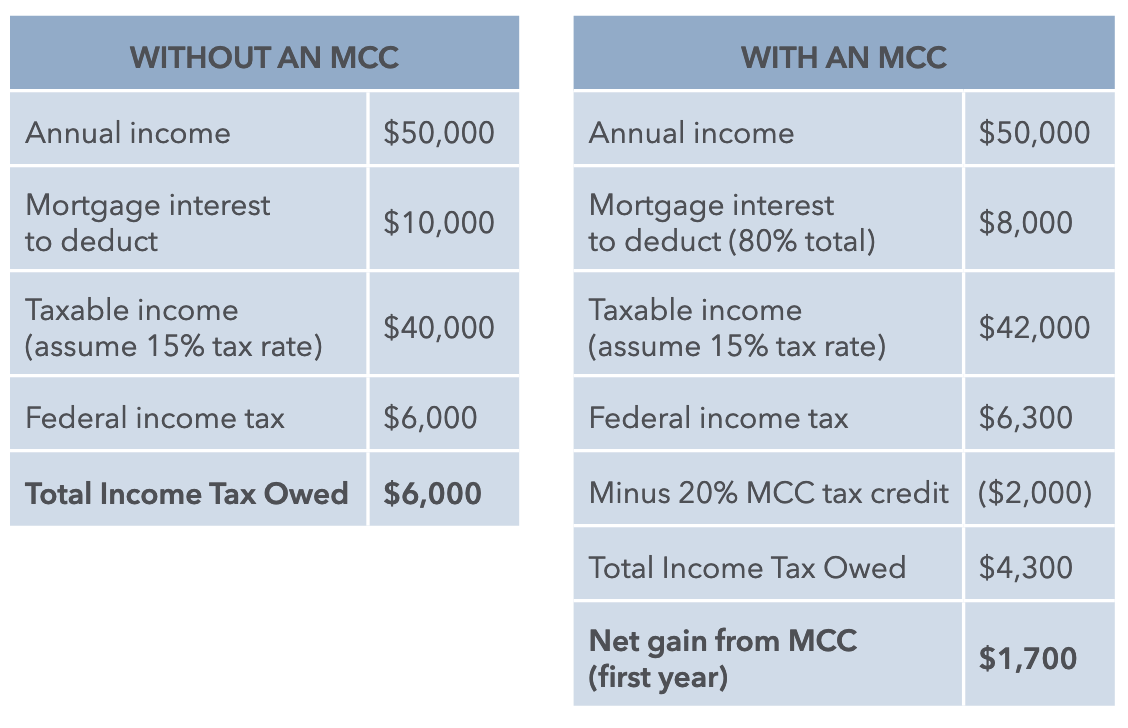

The amount you could save on your tax bill with an MCC could be considerable. Let’s explore an example that appears on the Federal Deposit Insurance Corporation’s (FDIC’s) website.

FDIC assumes that a couple, Joe and Sylvia, are buying their first home with a combined income of $50,000. And that they’ll pay $10,000 in mortgage interest during their first year as homeowners.

Chances are, Joe and Sylvia take the standard deduction. Most people on modest incomes do. But they still stand to make a big tax saving through their MCC. Because they’ll get a $2,000, dollar–for–dollar credit on top of the standard deduction.

The FDIC shows a simplified version of Joe and Sylvia’s taxes as side–by–side tables with and without an MCC. These assume they do deduct their mortgage interest. But the bottom line shows the MCC reduces their tax bill by $1,700:

Source: FDIC.gov

Other forms of home buyer assistance

Mortgage credit certificates are the unsung heroes of many homebuyers. They can provide continuing relief from the costs of homeownership. But MCCs are not available to everyone because only a small majority of states offer them.

However, don’t despair, even if you can’t get one. Because almost every state offers other forms of valuable homebuyer assistance.

Down payment assistance

Many home buyers report that saving for a down payment is the biggest obstacle they face. And that’s why down payment assistance programs (DPAs) were invented.

DPA programs are often administered by state, city, or county HFAs, just like mortgage credit certificates. And they can have similar eligibility criteria (see above). Down payment assistance might also be offered by local nonprofits and even some private mortgage lenders.

There are four main types of down payment assistance. The funds may come to you in the form of a:

- Second mortgage you repay in line with your main home loan

- “Silent second mortgage” with no monthly payments and 0% interest rate. You repay the entire sum when you move, sell, or refinance

- Forgivable silent second mortgage with no monthly payments and 0% interest rate. The loan is forgiven either in stages or at the end of a set period (often 5–10 years)

- Grant, which never has to be repaid and is an outright cash gift

The amount you can receive also varies considerably from program to program. Sometimes it’s a few thousand, but some go well into five figures. Occasionally, you can get every cent you need for your down payment and closing costs.

Closing cost assistance

Some HFAs help with closing costs, too. These fees often add up to between 2% and 5% of your mortgage loan amount. So they can be a real burden for homebuyers.

Check to see if the DPA programs covering your area will also help with your closing costs. This may be included with the down payment assistance funds or offered as a separate program.

But don’t get your hopes up before you’ve confirmed the policy. Because many don’t help at all with these costs.

Mortgage credit certificate FAQ

No. Most state housing finance agencies offer MCCs. But many don’t. And, of course, you must be eligible for the program to get one.

Application processes vary by HFA. See if the HFAs covering your area offer MCCs. If they do, either ask the HFA itself or one of the mortgage companies on its list of approved lenders.

A mortgage credit certificate is tied to your mortgage. And it lasts as long as your mortgage does. So it will stop being valid if you refinance, move out or sell the home. But note that it will very gradually become less valuable as you pay less toward mortgage interest and more toward your loan’s principal balance over time.

You simply submit an IRS form 8396 each year when you file your taxes. It’s a fairly simple form to complete.

It depends on what you mean by that. An MCC doesn’t prevent you from refinancing. But the certificate will stop being valid if you do. In other words, you won’t be able to claim your mortgage tax credit after you refinance.

The Mortgage Reports is not a tax site. This information is for general guidance only. Consult with a tax professional about your specific situation.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.