Liz Looks at: The Fed’s May Statement

50 is the New 25

On Wednesday, the Federal Open Market Committee (FOMC) announced a 50 basis point increase in the Fed Funds Rate to a new target range of 0.75-1.0%. This was the first 50 basis point hike since 2000, and — although widely anticipated by markets — is only the first of likely multiple larger hikes in an effort to control inflation.

The Fed’s “preferred” inflation measure is personal consumption expenditures (PCE) excluding food and energy, which currently sits at 5.2%. Despite being lower than the often talked about Consumer Price Index level of 8.5%, PCE is still markedly above the Fed’s 2% inflation target.

Given that inflation levels haven’t been this high in 40 years, the Fed is rightfully taking a more aggressive stance than in years past when rate hikes were typically 25 basis points. However, the bigger risk that remains is whether it’s still too little too late.

Re-Entry is Different from Rescue

Coming into the pandemic in March 2020, in order to prevent further financial market meltdown, the Fed cut its policy rate by 50 bps on Mar 3 and another 100 bps on Mar 16 — both as emergency moves outside of the Fed’s regular meeting schedule.

If we can cut so quickly, why can’t we hike as quickly and get it over with? Because the idea is that it’s safer to take a more gradual approach and gauge the impact along the way than to be too aggressive and need to reverse course later (a la December 2018).

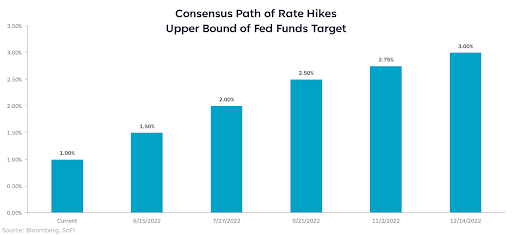

Here’s what “gradual” looks like to the market after May’s meeting:

The expectation is for three more 50bp hikes by the September meeting, with the Fed Funds Rate reaching an upper bound of 3% by the end of the year. The Fed continues to say that they will act as necessary to control inflation, but perhaps the biggest takeaway from Jerome Powell’s comments was that they were not considering a 75bp hike in future meetings.

The immediate reaction in markets was positive. More confirmation that gradual is easier to digest.

Strong Enough to Stay on Plan

At the end of the day, nothing has really changed. Inflation is still high and the labor market remains tighter than a tightrope. The Fed is still on its plan of tightening until they find a neutral rate that ideally helps temper these hot inflation readings and brings demand and supply back into balance.

The economy is strong enough, for now, to withstand the beginning of tightening. The market has fallen enough, for now, to account for higher rates. Make no mistake: we are still in the hard part, and a graceful landing is not certain. I am hopeful, however, that getting two more hikes behind us can be the beginning of a better second half.

Things are changing daily within the financial world. Sign up for the SoFi Daily Newsletter to get the latest news updates in your inbox every weekday.

Sign up

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22050502

Comments are closed.