Liz Looks at: Precarious Patterns

It’s Not Over Till It’s Over

The good news is that when this rough patch is over, we can look back on it as another history lesson and use it as a guide for cycles to come. The bad news is I don’t think it’s over yet. But we’re getting closer.

As is always true, the market looks forward while economic data looks backward. The size of the time-gap between the two varies, but is measured in months — not days or weeks.

At this point, with a drawdown of almost 30% in the Nasdaq and almost 20% in the S&P, we can agree that the market started “forecasting” rough waters months ago. The reason I don’t think it’s quite over yet is because the economic data hasn’t entirely caught up.

It’s Always Darkest Before the Dawn

Last week I wrote that the temptation to call peak inflation has become almost as contagious as the temptation to call a market bottom. As has been proven many times, calling bottoms with any consistent accuracy is nearly impossible.

What we can do, however, is shift our focus to some of the economic indicators that haven’t cracked yet. If the market cracks first, the economic data should crack later and we can start to feel more confident that the darkest hours are behind us.

What am I watching? The stuff that everyone keeps saying is so strong — the last few items in the “pros” column after so many moved to “cons.”

The most important of these is the consumer. Let me be clear that I’m not hoping for the consumer to fall apart. I’m simply saying that there likely needs to be some cooling in a few more metrics in order for inflation to fall, for the Fed to retract its claws, and for us to confirm that the market can stop forecasting dreadful days ahead.

Spending With a Vengeance

Despite inflation scaring the heck out of markets, it hasn’t yet scared the heck out of consumer spending. Which means demand hasn’t cooled much, and higher prices haven’t stopped the post-Covid revenge spending spree.

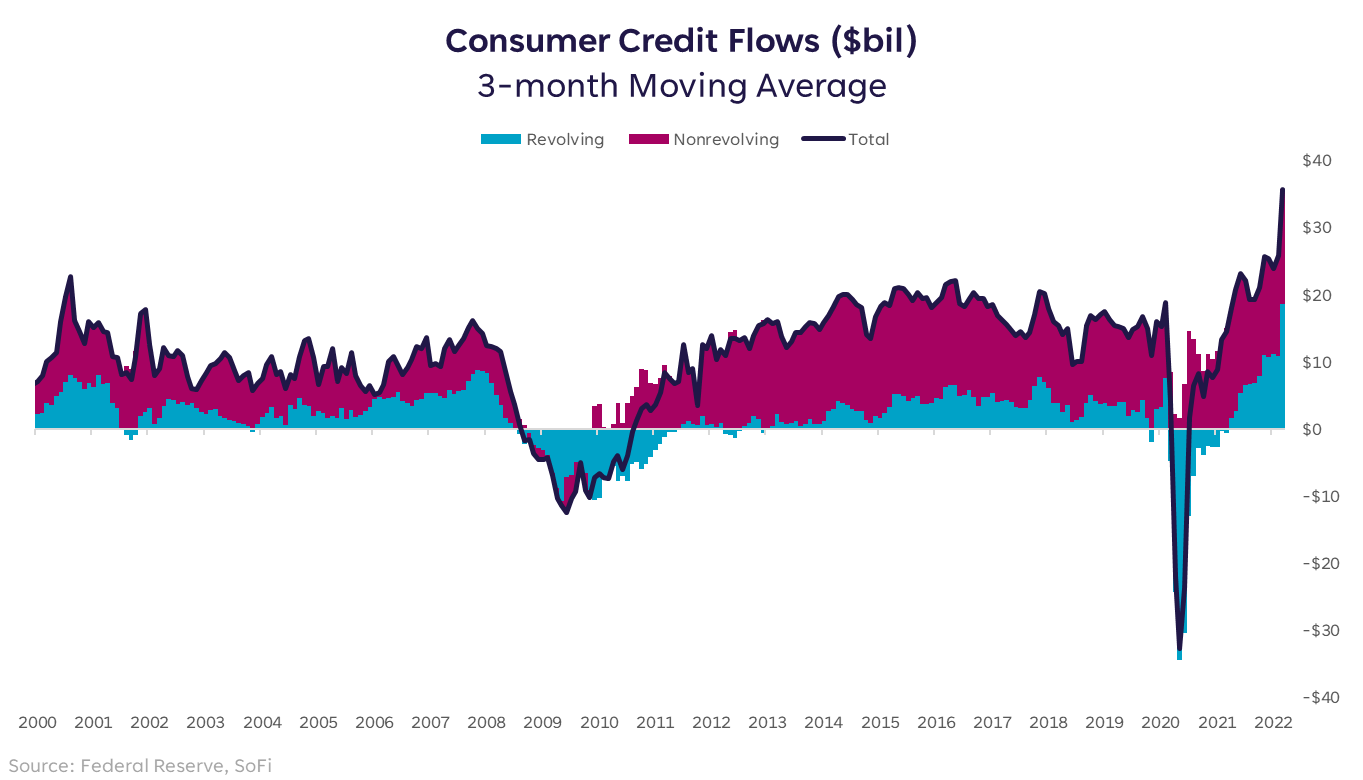

BUT, something that says the spending is getting a little harder to stomach is the recent growth in revolving consumer debt (below).

Yes, consumers built up their savings during the pandemic to $2.5 trillion, and that number still sits around $2.4 trillion. And yes, personal income levels have risen. But the personal savings rate has fallen to 6.2% — below the pre-pandemic level of 7.3%. Which means the level of spending increased faster than the level of income.

At some point, people have to make tough choices and demand should cool. The data that will reflect the cooling is personal consumption expenditures, retail sales, and revenues of consumer-dependent companies. In turn, inflation should reflect a more balanced supply/demand relationship.

Dropping Shoes

While we wait for some of the last shoes to drop, and for the darkest days to be behind us, stay focused on diversification and investing, not trading. This type of bumpy environment is when short-term trades can turn into long-term mistakes. Instead, work on building a portfolio that has allocations to high quality growth opportunities, while diversifying it with defensive positions for those rough periods. And wait for the gap to close between market action and economic data.

Want more insights from Liz? The Important Part: Investing With Liz Young, a new podcast from SoFi, takes listeners through today’s top-of-mind themes in investing and breaks them down into digestible and actionable pieces.

Listen & Subscribe

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

Investment Risk: Diversification can help reduce some investment risk. It cannot guarantee profit, or fully protect in a down market.

SOSS22051902

Comments are closed.