Investing in real estate: Beginner’s guide

Get started investing in real estate

So you’re thinking of investing in real estate. Congratulations! Many before you have found it a great way to increase their net worth. And some have become seriously rich.

Of course, investing in real estate can mean lots of different things – from buying a house to live in, to renting out vacation homes, to fixing–and–flipping.

However you plan to invest in real estate, here’s what you need to know to get started successfully.

In this article (Skip to…)

Getting started with real estate investing

If you’re brand new to the world of real estate investing, you’ll find that there are many possible paths to take.

The simplest form of real estate investing is buying a home for yourself to live in. While many don’t think of this strategy as ‘investing,’ a primary home is actually a great investment in that it will generally increase in value and boost your net worth substantially over time.

Buying your own home is a great way to invest in real estate with relatively little money because you can often purchase with as little as 0–3% down. Plus, when you’re ready to move or upsize later on, you can either sell your house – typically for a profit – or keep it and rent it out, earning yourself passive income.

Jon Meyer, licensed loan officer and The Mortgage Reports loan expert, says that this is potentially the best way to get into rental property ownership, adding “you can get better rates and terms, and potentially make more money in the long run.”

But let’s assume you’ve already explored primary homeownership. Now you’re looking for different ways to invest in real estate and grow your net worth. In that case, here are a few strategies worth looking into.

Six ways to get started with real estate investing

There are a variety of ways to invest in real estate. Some are far more hands–on than others. And each one will involve a different level of financial and time commitment.

Ways to start investing in real estate:

- Multifamily homes

- Vacation homes

- Investment properties

- Flipping homes

- Buy, Rehab, Rent, Refinance, Repeat (the BRRRR method)

- Real estate investment trusts (REITs)

With these six, we’ll be looking in greater depth at residential properties. If you wish to invest in commercial property (retail outlets, hotels, offices, warehouses, factories, etc.) this information won’t be relevant to you.

1. Buying a multifamily home

Many people’s first investment property is a multifamily home. When you buy a house with 2, 3, or 4 units, you get the dual benefit of owning a home to live in as well as one or more investment units that can be rented out.

Even at the start, you might find that the rents you receive more or less cover your mortgage. And, as time passes and rents rise, you could find yourself with a worthwhile income.

As long as you plan to live in one of the units yourself, you can use just about any mainstream mortgage to finance a multifamily home with up to four units. Options might include:

- Conventional loan: 3–20% down, 620 credit score minimum

- FHA loan: 3.5% down, 580 credit score minimum

- VA loan: 0% down, 580–620 credit score minimum

Keep in mind that there can be challenges with this method. Tenants have to be found and screened, repairs have to be made, maintenance has to be done, rents have to be collected and chased, and so on.

And, unless you have the money to pay someone else to do this stuff, it will all be down to you. “A typical property manager can cost you around 10 percent of your rents received,” adds Meyer.

So before you go this route ask yourself, Should you become a landlord?

2. Buying a vacation home

A vacation home can serve two purposes: It gives you someplace to stay when you travel and it can earn you rental income when you’re not visiting.

That rental income can help pay your vacation home mortgage and cover other expenses, like maintenance, repairs, property taxes, and homeowners insurance.

Another benefit of owning a vacation home is that you can finance it affordably. Second home mortgage rates are only a hair above primary home mortgage rates, and you simply have to verify that you’ll stay in the property at least part of the year.

Of course, as with any landlord, vacation homeowners have a pile of costs associated with their rental business. If you’re not able and on hand to do things yourself (cleaning, liaising with vacationers, sorting out issues, collecting rents, marketing), you’ll have to pay someone else to do it all.

For more information, see: Five questions to ask yourself before you buy a vacation home.

3. Buying an investment property

An investment property is a single–family or multifamily home that you rent out full time and do not live in yourself. These types of properties can generate an impressive income over time, especially if you own more than one. But it tends not to be easy at the start. Your mortgage costs are likely to be high, as will maintenance costs unless you do most chores yourself.

If you’re not willing or able to maintain your investment homes yourself, it’s a good idea to get quotes from local property managers or line up your direct labor before you commit to a purchase.

Another challenge is that there can often be gaps between tenants. And that means a lapse in rental income.

Indeed, when your mortgage lender runs the numbers, it will typically assume that your vacancy rate (when you’re not getting an income) will be 25%. That means you’ll need a significant income or savings buffer to ensure you can cover mortgage payments even if you have vacancies.

In terms of financing, buying an investment property is a little tougher than buying a primary home. You’ll need to meet higher standards for credit, down payment, and cash flow.

That said, your future rental income can actually help you qualify for the loan. “Lenders can use 75 percent of the future rents as qualifying [income] based on current leases and/or an appraised rent schedule,” explains Meyer.

Provided you can afford the upfront cost, investment properties can be an excellent way to generate substantial, long–term income.

For more. information see our Guide to investment and rental property mortgages.

4. Flipping homes

Anybody who’s spent more than about 10 minutes tuned in to HGTV will know all about flipping. You buy a rundown home, make improvements (mostly cosmetic ones, you hope), and sell it for a handsome profit.

Some people make a good living doing this. But the process can have serious pitfalls. Most scarily, you might buy somewhere that has major structural issues that you didn’t spot before you purchased.

Assuming you don’t have all the relevant skills yourself, you can minimize the dangers by teaming up with people who do. Many successful flippers have favorite real estate agents and contractors on speed dial. So they know the figures and the likely work required right from the start. Some even go into partnerships with experts.

Financing a fix–and–flip home can also be a bit tricky. You won’t be able to use a standard mortgage on a fix–and–flip home. So you may have to finance it yourself using savings or the equity in your current home (this can be done with a second mortgage or cash–out refinance).

Alternatively, you could partner up with a friend, family member, or business partner who’s able and willing to finance the project in return for a share of the sale proceeds.

5. Buy, Rehab, Rent, Refinance, Repeat (The BRRRR method)

The BRRRR method stands for ‘Buy, Rehab, Rent, Refinance, Repeat.’ And it’s a bit like house flipping. Except, instead of selling the home when it’s sale–ready, you rent it out.

But how do you finance your next purchase and rehab when you haven’t sold the last one? Simple! You refinance the last home and use the cash to fund the next project. And you keep doing that.

This way you can quickly build up a portfolio of rental properties. And some find it highly profitable.

However, you need all the skills house flipping requires, plus all the skills a landlord must have. And the sheer volume of work involved means you’re probably going to have to outsource many tasks.

6. Real estate investment trusts (REITs)

REITs are a more traditional form of investment. That is, you invest in the value of real estate without having to actually purchase, repair, manage, or sell the physical properties.

The US Securities and Exchange Commission (SEC) explains:

“Real estate investment trusts (“REITs”) allow individuals to invest in large-scale, income-producing real estate. A REIT is a company that owns and typically operates income-producing real estate or related assets.

“Unlike other real estate companies, a REIT does not develop real estate properties to resell them. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio.”

When it comes to investing in real estate, REITs may be the easiest way. No mortgages to arrange, no property maintenance or repairs, no tenants. You really do get to sit back and let the money roll in.

But, as with all investments, the bigger the return you’re offered, the bigger your risk. So do your due diligence and carefully research each REIT, as you would with any sound financial investment.

Probably the safest forms of REITs are those registered with the SEC and publicly traded on a stock exchange.

For more information, read the relevant page on the SEC’s website.

Which type of real estate investing is right for you?

Most people find owning their own home a great way to begin investing in real estate. And some enjoy taking in a renter or two to bring in a little income on the side. This basic strategy involves some work and costs. But those are baked in for any homeowner.

Unless you opt for a REIT, other forms of real estate investing involve scaling up the burdens, risks, and rewards of homeownership. The more work you do yourself, the more profit you stand to make.

Being a landlord isn’t as easy as it sounds, certainly in the early years. Tenants can be difficult to manage. But you want to keep the good ones for as long as possible so you minimize your vacancy rate. And, depending on the buildings you buy, it can be expensive to keep units up to scratch, even if you do provide most of the labor.

Renting out a vacation home can involve even more work. And, unless you buy somewhere near your main residence, you might have to outsource an endless list of chores. Obviously, that will eat into your profits.

But there’s a lot of money to be made in real estate. Do you have the determination and staying power to take a chunk of it for yourself?

If not, REITs may provide good returns with little effort. If that’s what you mean when you think of investing in real estate, go for those. But take great care when selecting yours.

Risks and rewards of investing in real estate

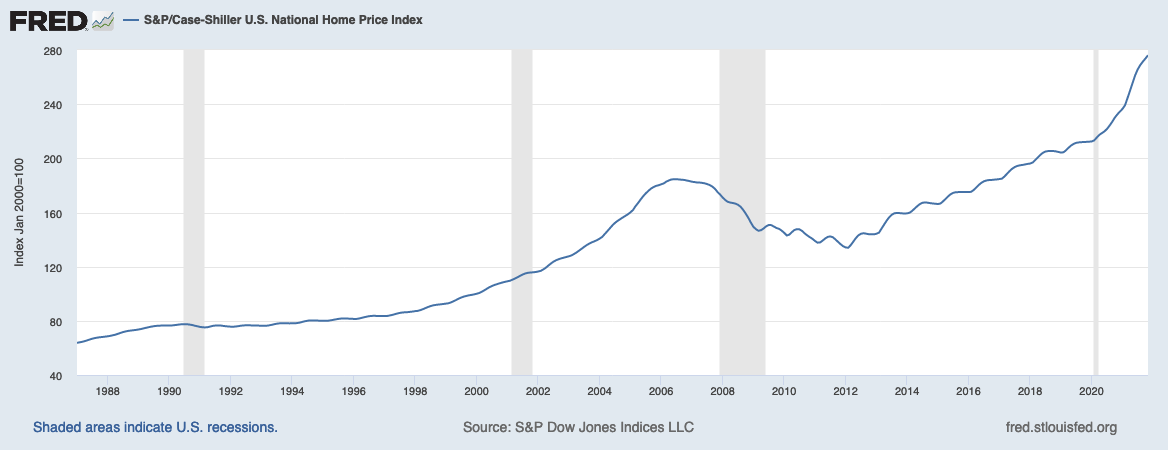

Of course, all investments carry risks. And investing in real estate is no exception. A recession or depression may see tenants in financial trouble and unable to pay their rent. And there are times when home prices fall, though rarely for long, as this graph from the Federal Reserve Bank of St. Louis shows:

Source: Federal Reserve Bank of St. Louis

If you’d bought a home at the median price nationwide in the depths of the last dip (February 2012), you’d have more than doubled your money over the next decade. And that’s just in home price appreciation. The profits you’d have received as rent on an investment property or vacation home would be on top of that.

Know your market

But be aware that those are nationwide averages. Just as there are many hot spots where home price appreciation is much higher than across the country, there are plenty of cold spots where prices have been stagnant or have barely moved. Indeed, in some places, home prices have fallen.

That’s why one of the golden rules of investing in real estate is “location, location, location.”

Research the property market where you’re buying and make sure you thoroughly understand its dynamics. You certainly need to understand the market for homebuyers and sellers. But, if you plan to rent the property out, you must also fully grasp the rental market.

Your next steps to investing in real estate

You need to see real estate investing as a business venture. And that means being businesslike.

So begin by investing your time in research. Use the links we provided above and then keep reading. You need to know all about your chosen way of making money from property – most importantly, the potential pitfalls.

Once you understand the business model you’ll be pursuing, see whether it fits within the property market in your chosen area.

- How quickly, if at all, are home prices rising?

- What about rents?

- How easy is it to find new tenants?

You can find much of that data online and good sources include Realtor.com and Apartments.com. But don’t stop there.

Cultivate contacts with real estate agents and contractors in your area. Most are willing to share their expertise with newbies, especially if they sense you might bring them future business. And other landlords can also tell you about how they’re finding local market conditions.

Talk to a lender about your options

Assuming you want to invest in real estate directly – by purchasing a property – you’ll also need to talk to a mortgage lender. Explain the type of investment you’re aiming for, ask about loan options, and find out what it will take to get qualified.

Your lender will be able to give you a detailed breakdown of your future mortgage costs, and that will help you understand the cost vs. potential benefit of your new investment property.

Ready to get started?

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.