Illinois Student Loans: Debt Stats, Repayment Programs and Refinancing Loans

Illinois private and federal student loan borrowers owe an average balance of $36,531 — sixth-highest in the nation and just below the national average of $36,689.

The suspension of certain federal student loan payments has been extended through Aug. 31, 2022, but that doesn’t mean Illinois borrowers are in the clear. If you’re dealing with Illinois student loans, here’s what you need to know.

Illinois student loans: Borrowers owe average of $36,531 in federal, private debt — and more facts

| Illinois student debt overview | |

|---|---|

| Average balance | $36,531 |

| Total outstanding debt | $64 billion |

| Number of borrowers | 1.7 million |

| Average total monthly payment | $292 |

| Note: Averages include federal and private student loan debt. | |

Illinois community colleges can be a go-to option for students looking to keep their loan debt low. The state has around 50 community colleges, including seven in the City Colleges of Chicago system.

Not only can you attend community college, but you can also apply for some of the programs designed to reduce student costs. One of the most prominent programs, the Monetary Award Program, is an Illinois grant based on need. If you’re an Illinois resident attending a state school, you’ll be considered for this grant based on the information submitted in your Free Application for Federal Student Aid (FAFSA). There are also grant programs aimed at veterans, National Guard members and dependents of fire and police officers.

Even with these programs — and amid a global coronavirus pandemic — 1.7 million borrowers still rely on student loans to help them pay for higher education.

Student loan debt in Illinois’ largest counties, from Cook to Will

| Student loan debt in most populous Illinois counties | ||

|---|---|---|

| County | Average student loan balance | Average monthly student loan payment |

| Cook | $37,748 | $312 |

| DuPage | $37,009 | $314 |

| Kane | $32,074 | $288 |

| Lake | $37,214 | $326 |

| McHenry | $32,707 | $287 |

| Will | $37,060 | $258 |

| Note: Limited to counties with a population of at least 300,000 residents; averages include federal and private student loan debt. | ||

Student loan debt by ZIP code in Illinois’ largest city: Chicago

Loan repayment programs for Illinois residents

If you’re looking for help, Illinois has some loan repayment programs, in addition to student loan forgiveness programs. These programs are contingent upon appropriations from the governor, as well as the Illinois General Assembly. Here’s what you need to know.

Illinois Teachers Loan Repayment Program

The Illinois Teachers Loan Repayment Program focuses on teachers who have already received some measure of federal teacher loan forgiveness. You must have a remaining student loan debt balance to qualify. You must also teach for five years at an elementary or secondary school that Illinois considers a low-income school to be eligible for up to $5,000.

John R. Justice Student Loan Repayment Program

With the John R. Justice Student Loan Repayment Program, you must agree to work as a state prosecutor or public defender. As long as you meet various requirements, you could be eligible for up to $4,000 a year, for an aggregate amount of up to $60,000. However, you have to be employed in a qualified manner for at least three years or repay any amount you received.

Nurse Educator Loan Repayment Program

For the Nurse Educator Loan Repayment Program, you must be willing to maintain a nursing educator career in Illinois. You do need to fulfill a requirement of teaching for at least 12 months prior to initially applying for the program. Additionally, you must be a licensed nurse educator and meet other requirements. The annual award is worth up to $5,000, for up to four years.

Veterans’ Home Medical Providers’ Loan Repayment Program

If you work in a veterans’ home, you might be eligible for the Veterans’ Home Medical Providers’ Loan Repayment Program, which targets different health care providers. Qualified providers can include doctors, nurses, nursing assistants and others. There’s an annual award of up to $5,000 for up to four years.

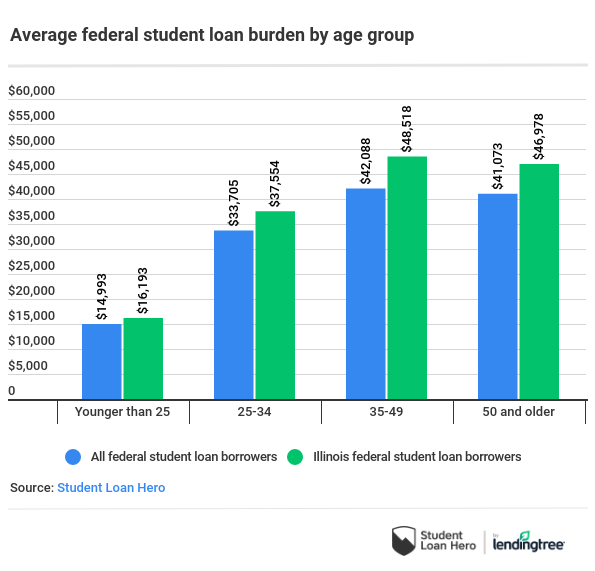

Illinois federal student loan borrowers younger than 25 owe more than national average — and more comparisons

How to refinance student loans in Illinois

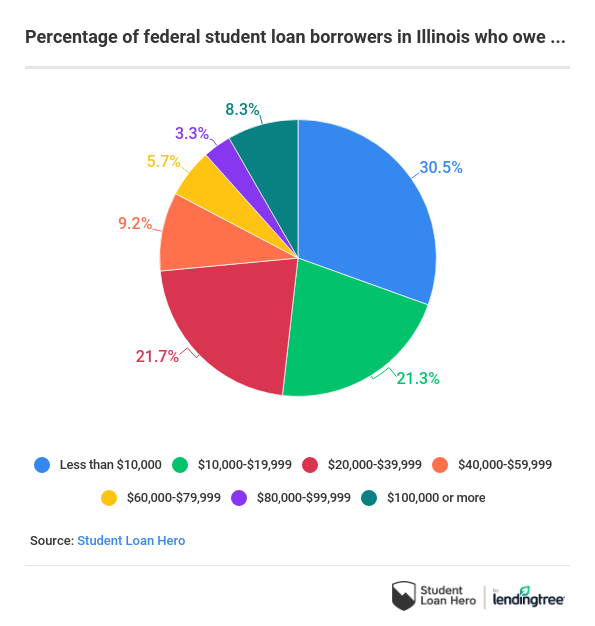

With more than 8% of borrowers in Illinois owing $100,000 or more in student loans, refinancing could provide significant savings for graduates struggling with their payments. You’re especially likely to see better results if you have a strong credit profile.

Student loan refinancing replaces your old student loans with a new private student loan. Your new student loan servicer pays off your existing federal and/or private student loans and you then make payments on a single student loan.

One main benefit of refinancing Illinois student loans is the lower interest rate, which can reduce what you owe overall. Plus, you only have to worry about one payment.

Realize, though, that once you refinance to a private loan, you’re no longer eligible for federal loan protections, including:

- Income-driven repayment

- Federal loan forgiveness programs

- Deferment and forbearance

If you want to maintain federal loan forgiveness as an option, it’s possible to refinance only your private loans. Some of the best private student loans offer some form of hardship protection and other features. Carefully consider how to move forward, and whether your interest savings are enough to offset losing potential government protections.

Sources

- U.S. Department of Education data as of June 30, 2020

- Anonymized My LendingTree June 2020 credit reports

- Federal Reserve Bank of New York Consumer Credit Panel/Equifax as of June 2020

- mappingstudentdebt.org

Because the latter data is from 2015, researchers estimated the increase in student loan debt per borrower in the state using statewide data from anonymized credit reports.

Interested in refinancing student loans?

Here are the top 9 lenders of 2022!

Comments are closed.