First-time home buyer down payment: How much is needed?

First-time home buyer down payments start at 3%

Certain home loan programs allow 0% down. But these have special requirements. So realistically, most first-time home buyers need at least 3% down for a conventional loan or 3.5% for an FHA loan.

That means for a first-time home buyer down payment, you’d need to save around $10,500 to $12,250 to buy a $350,000 home.

If you qualify for down payment assistance, you might need even less. So if saving for the down payment is a challenge, be sure to ask your lender what help is available.

In this article (Skip to…)

>Related: How to buy a house with $0 down: First-time home buyer

Basics: What is a down payment?

Unless you can buy your new home with cash, you need financing — a mortgage loan.

Sometimes, a bank will lend you the entire amount you need to buy a home. This is known as 100% financing.

But most mortgage loans require some contribution from you, the borrower. This contribution — the upfront amount you put toward the house out-of-pocket — is called a “down payment.”

For example, if you purchase a new home for $100,000 and borrow $90,000 (90%), you would put $10,000 down on the house. That’s a 10% down payment.

What’s the average down payment on a house for a first-time buyer?

Many first-time home buyers believe they need 20% down. But that’s far from true.

In fact, the average down payment for first-time home buyers under the age of 30 is just 6%. On a $300,000 home, that comes out to an $18,000 down payment.

The average down payment for first-time home buyers under the age of 30 is just 6%.

And you’re allowed to put down even less. If you have a credit score of 620, you might qualify for a mortgage with just 3% down — or $9,000 out of pocket for a $300,000 home.

Thanks to the low-down-payment mortgages available today, many first-time home buyers find the process a lot more affordable than they initially thought. Yet, keep in mind that if you don’t put 20% down, you’ll have the additional cost of private mortgage insurance (PMI). We discuss this in more detail below.

Don’t forget about closing costs

A down payment isn’t the only out-of-pocket cost for first-time home buyers. You also need to pay for closing costs.

- Closing costs cover all the fees associated with setting up your loan — from the lender’s fees to the appraisal, credit report, title fees, and more

- Closing costs are typically around 2% to 5% of the loan amount. (Although, it’s rare for them to be as high as 5% unless the loan is quite small)

- This means you should budget for at least 3% to 4% of the loan amount in cash, on top of your down payment budget

Down payment and closing costs example

For example, say you’re buying a home for $300,000 and you plan to make a 5% down payment. You should include around 4% for closing costs in your estimate to make sure you’ve saved enough for your total out-of-pocket cost.

- Home price: $300,000

- 5% down payment: $15,000

- Loan amount: $285,000

- 4% for closing costs: $11,400

- Total savings needed: $26,000

It’s important to budget for closing costs when you’re planning to buy a home. Otherwise, your down payment savings could take a big hit when you realize you need to use them to pay for closing costs, too.

However, as we explore below, there are a variety of programs to assist first-time buyers with down payments, closing costs, and financing.

How much down payment can you afford right now?

First-time home buyers often overestimate how much they need for a down payment. Consider the HomeReady loan, a popular mortgage for first-time home buyers that requires only 3% down.

On a $250,000 house, that’s an $7,500 down payment — which is not much more than the amount an average American has in their savings account: $5,300.

HomeReady loans aren’t the only first-time home buyer loan with a low down payment, either. All of the following loans let first time home buyers put 5% down or less:

Of course, you might decide to pay more than the required down payment for your home loan, depending on your financial goals. A bigger down payment can reduce your monthly mortgage payments and help you save on interest.

But if your main goal is to become a homeowner in the near future, one of these loans could help you achieve your dream sooner than you thought.

How much do first-time home buyers have to put down?

Some home buyers can put zero percent down using a VA or USDA loan. But only certain borrowers will qualify for these mortgage programs. Most other buyers will need at least 3-3.5% down.

Imagine you want to buy a $250,000 house. Here’s how much you might have to put down as a first-time home buyer, depending on your qualifications:

| Credit Score | Debt-to-Income Ratio | Loan Type | Down Payment | Down Payment $ Amount |

| 500-580 | 40-50% | FHA Loan | 3.5% | $8,750 |

| 620+ | Up to 45% | Conventional Loan | 3% | $7,500 |

| 620+ | Up to 41% | VA Loan | 0% | $0 |

| 640+ | Up to 41% | USDA Loan | 0% | $0 |

To qualify for one of those zero-down first-time home buyer loans, you have to meet special requirements.

- For a VA loan, you need to be an eligible U.S. Armed Forces veteran or service member

- For a USDA loan, you need to buy a house in a qualified “rural area” — which usually means a population of 20,000 or less — and meet local income limits

But the other two loan types, conventional and FHA, are a lot easier to come by.

You’ll still need to meet minimum credit score requirements as well as employment and income guidelines with one of these, just like any other home loan. But there are no ‘special’ requirements to get a low-down-payment FHA or conventional loan as a first-time home buyer.

How much should a first-time home buyer put down?

The amount you put down as a first-time home buyer is up to you. For instance, you might qualify for a conventional loan with just 3% down. But then you’d have to pay for private mortgage insurance.

Unlike homeowners insurance, private mortgage insurance wouldn’t benefit you directly. Instead, it would compensate your mortgage lender if you defaulted on the loan.

If you can afford it, you might decide to make a 20% down payment to avoid mortgage insurance. This would lower your loan amount and monthly payment.

Take a look at one example:

| First Time Home Buyer Loan | Minimum Down Payment | Down Payment for a $250,000 house | Monthly Payment (Principal & Interest / Mortgage Insurance)* |

| Conventional LoanWITH Mortgage Insurance | 3% | $7,500 | $1,363 ($1,123 / $240) |

| FHA Loan | 3.5% | $8,750 | $1,311 ($1,137 / $174) |

| VA Loan | 0% | $0 | $1,184 ($1,184 / $0) |

| USDA Loan | 0% | $0 | $1,243 ($1,169 / $74) |

| Conventional Loan WITHOUTMortgage Insurance | 20% | $50,000 | $926 ($926 / $0) |

*The example above assumes a 30-year fixed-rate mortgage with a 3.75% interest rate

As you can see from the table above, there are certain benefits to making a bigger down payment. Namely, you have a smaller loan amount. That means your monthly payments are smaller.

You’ll also be able to avoid paying PMI if you put down 20% or more. That can shave another $100 or more off your monthly bill.

But making a smaller down payment has benefits, too — even if they aren’t as obvious.

Benefits of a smaller down payment

If you want to get into a house sooner, it often makes sense to make a smaller down payment with what you have saved now (or what you will have saved in the near future).

Some of the benefits of making a smaller down payment include:

- You keep money in your emergency fund

- You save money to make improvements and repairs to your new place (which many home buyers end up having to do)

- You can get into a house and start building equity sooner — instead of waiting to save up the 20% down payment requirement to avoid PMI on a conventional loan

- If you wait, the price of real estate will likely continue to rise along with how much money you need to save

Finally, remember that your mortgage isn’t set in stone.

If you put down a smaller amount of money, you can usually refinance a few years down the road to get rid of mortgage insurance and reduce your monthly mortgage payment.

In other words, you can get your foot in the door of homeownership with a smaller down payment on your first mortgage loan. Then, after you build some equity, you can transition to a more “ideal” loan.

First-time home buyer down payment strategies

Saving for a big down payment is not always the most advantageous strategy for some first-time buyers. It’s common for many to use a mix of savings, gifts, grants, and low-down-payment loans to buy their first home.

Here are a couple of options for first-time buyers to consider if they need help with the down payment:

- Down payment assistance programs

- Gift funds

1. First-time home buyer down payment assistance programs

Here’s the good news: If you’re a first-time home buyer, you might not have to cover the whole down payment yourself.

First-time buyers can apply for grants or low-interest second mortgages — called down payment assistance programs (DPAs) — to help with their upfront contribution.

There are more than 2,500 of these DPAs nationwide. Many of these programs are run by nonprofits or local governments. Qualified buyers can receive anywhere from $2,000 to more than $39,000 toward their down payment and/or closing cost assistance.

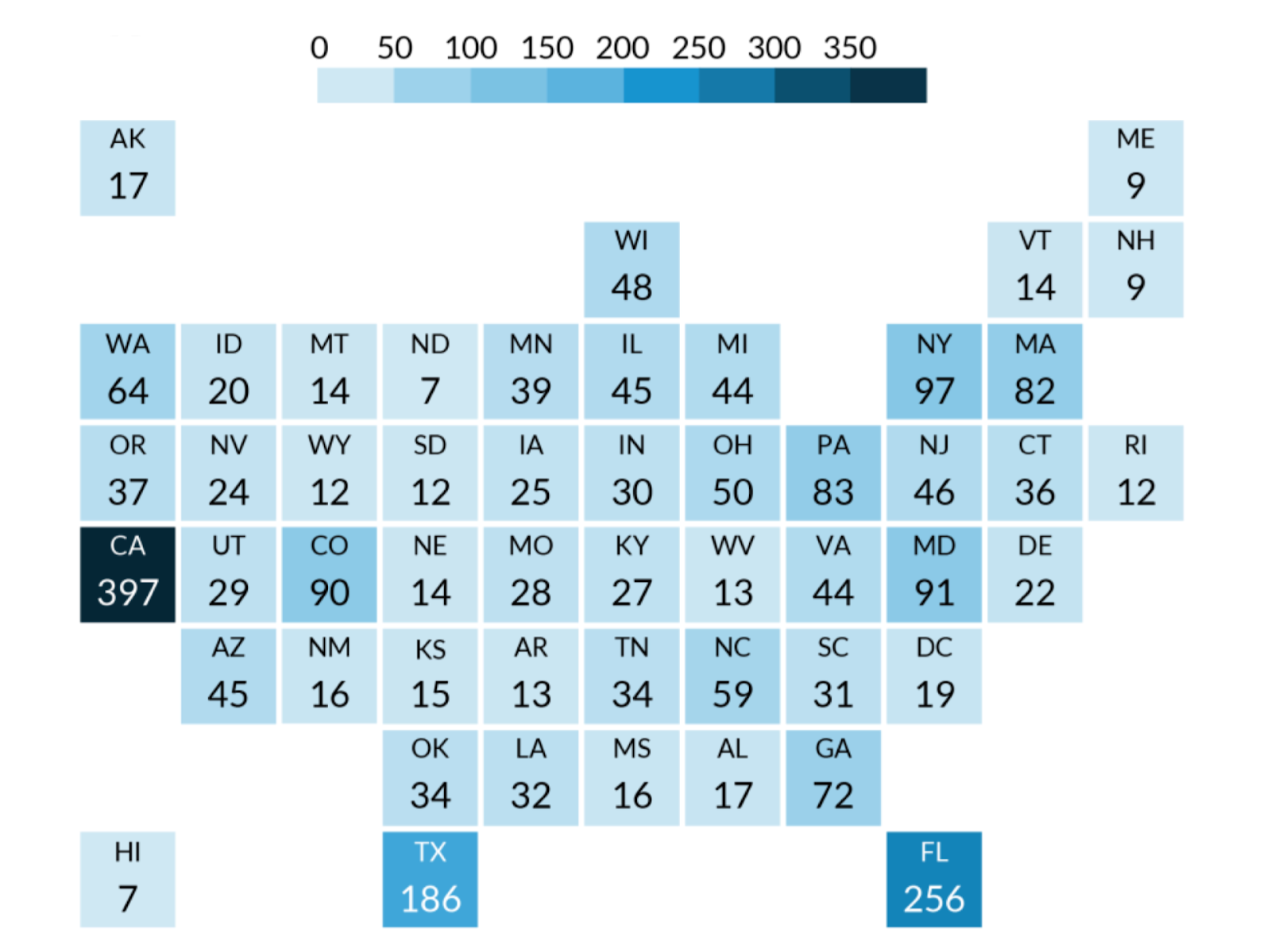

Number of down payment assistance programs by state

Source: Down Payment Resource and The Urban Institute

It’s hard to generalize who qualifies for down payment assistance because all 2,500 programs could have slightly different guidelines. But it’s common for these programs to prefer first-time home buyers, low- to moderate-income, and targeted “development areas.”

Look for first-time home buyer programs near you to see what down payment assistance you may qualify for.

These are often run by state and local governments, and can be found by Googling “down payment assistance grants in [state, county, or city].”

2. Using gift funds to cover your down payment

Many first-time home buyer programs let you cover the whole down payment with gift funds.

For example: If you’re buying a $250,000 home with a 3.5% down FHA loan, your entire $8,750 down payment could be a gift from your parents.

The Conventional 97 loan and Freddie Mac Home Possible also allow 100% of the down payment to come from gift funds

Gift money can come from a parent, friend, employer, or anyone generous enough to help you out with your home purchase.

However, if you’re going to use gift funds toward your down payment, they have to be properly documented by the gift giver and the home buyer. That means writing a “gift letter” to show your mortgage lender the money came from a verified source.

This extra step in your home buying process will be worthwhile. Be sure to let your loan officer or real estate agent know early in the process that you’ll be using gift funds for a down payment.

First-time home buyer programs

As a first-time home buyer, you can choose how much money you want to put down towards the purchase price.

The down payment can be as large as you wish, or as small — so long as you make the minimum investment required by your lender and loan program.

The six most common low- and no-down-payment mortgages used by first-time home buyers are:

- FHA loan

- VA loan

- USDA loan

- Conventional 97

- HomeReady and Home Possible

Each first-time home buyer program is described below.

1. FHA loans: 3.5% down payment

Because these mortgages are insured by the Federal Housing Administration, FHA loans require a modest down payment of 3.5% of the purchase price at minimum.

FHA loans are popular with first-time home buyers because the program allows below-average minimum credit scores.

If you have a 580 credit score or higher, you can get approved for an FHA loan with just 3.5% down. And some lenders will even allow credit scores of 500 to 579 if you can make at least a 10% down payment.

Thanks to these perks and others, FHA mortgage approval standards are considered the most friendly toward first-time buyers.

Keep in mind the requirements to qualify for an FHA loan. You’ll need to buy a single-family home or condo that meets property standards set by the Federal Department of Housing and Urban Development (HUD).

Plus, FHA loans require what is called mortgage insurance premiums (MIP) for the life of the loan, and you must borrow within FHA loan limits.

2. VA loans: 0% down payment

VA loans are available to members of the U.S. military and veterans of the Armed Services.

These mortgages provide a 100% financing option — meaning zero down payment — and VA mortgage rates are often lower than those of other programs.

Another big benefit for first-time home buyers is that VA loans don’t require ongoing mortgage insurance.

Unlike FHA and USDA loans, which both charge mortgage insurance premiums every month, the VA loan simply has one upfront “funding fee” and that’s it.

Without the fee for monthly mortgage insurance premiums, homeowners can save thousands over the life of their VA loans.

3. USDA loans: 0% down payment

USDA or “Rural Housing loans” also allow 100% financing. The program is available for low-income buyers to purchase homes in rural areas and less-dense suburban neighborhoods nationwide.

The U.S. Department of Agriculture, which backs these mortgages, usually defines “less populated” as an area with 20,000 residents or fewer.

Another important guideline for USDA loans is the income limit. To qualify for a Rural Housing mortgage, you can’t make more than 115% of the local median income (meaning you’re 15% above the median).

USDA mortgage rates are often as low as VA mortgage rates. And mortgage insurance for USDA loans tends to be cheaper than for FHA loans.

4. Conventional 97 loans: 3% down payment

The Conventional 97 loan is, like the name implies, a type of conventional loan. These mortgages are backed by Fannie Mae and Freddie Mac.

Available to home buyers with a good credit score of 620 or higher, the conventional 97 loan requires just 3% down. And it lets you cover the whole down payment with gift funds if you wish.

5. HomeReady and Home Possible mortgage: 3% down

The HomeReady and Home Possible mortgages are two other conventional loan programs with 3% down payment requirements.

These are geared toward lower-income and/or multigenerational households, but all home buyers are welcome to apply.

The HomeReady program is backed by Fannie Mae and Home Possible by Freddie Mac. These loans may require borrowers to complete a homebuyer education course during the application process.

Home buyers using either HomeReady or HomePossible get access to discounted mortgage rates, and can use the income of boarders and other household residents to help meet the lender’s household income requirements.

First-time home buyer down payment FAQ

There are about 2,500 first-time homebuyer programs around the nation offering down payment assistance. These are typically run by state and local governments. Find programs near you by Googling “down payment assistance in [my city or county].” Or ask your Realtor for a list of options. Many down payment assistance programs offer grants or forgivable loans — meaning the money you use to cover your down payment might not need to be repaid.

You’ll have to cover the down payment and closing costs when you purchase a home. Closing costs, which cover things like lender fees, appraisal, credit reporting, and title fees, typically total 2 to 5 percent of the loan amount. Many down payment assistance programs can be used to help pay for closing costs as well. Or, you may be able to negotiate that the home seller covers part or all of your closing costs. (But this typically only happens in a buyers’ market.)

Low-down payment government loans, including FHA, USDA, and VA, are designed to help buyers purchase primary residences. That’s a home you plan to live in full-time. As such, these government-backed loan programs cannot be used to buy vacation homes or investment properties.

No, but you do need enough home equity to meet the requirements of your mortgage lender or loan program. Conventional loans generally require at least 3-5 percent home equity to refinance. Though, if you have less than 20 percent equity, you will pay mortgage insurance on the new loan.

A down payment will lower the amount you borrow which, in turn, can lower your monthly payments. For example, if you make a 20 percent down payment on a $200,000 loan, you’re borrowing only $160,000. That will result in lower payments spread over 30 years than if you were paying off a larger loan amount over the same time period. Other factors such as your repayment terms and interest rate also affect your monthly mortgage payments.

Find a low down payment loan that works for you

First-time home buyers have lots of options when it comes to making a down payment.

To minimize your out-of-pocket cost, make sure you research your loan options thoroughly, as many require just 0-3% down.

Then make sure you find a participating lender who offers the loan program you need.

And don’t forget to look into down payment assistance options near you. Help is available for first-time home buyers who know where to look for it.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.