Fannie Mae HomeReady mortgage: 2022 Guidelines

What is a HomeReady loan?

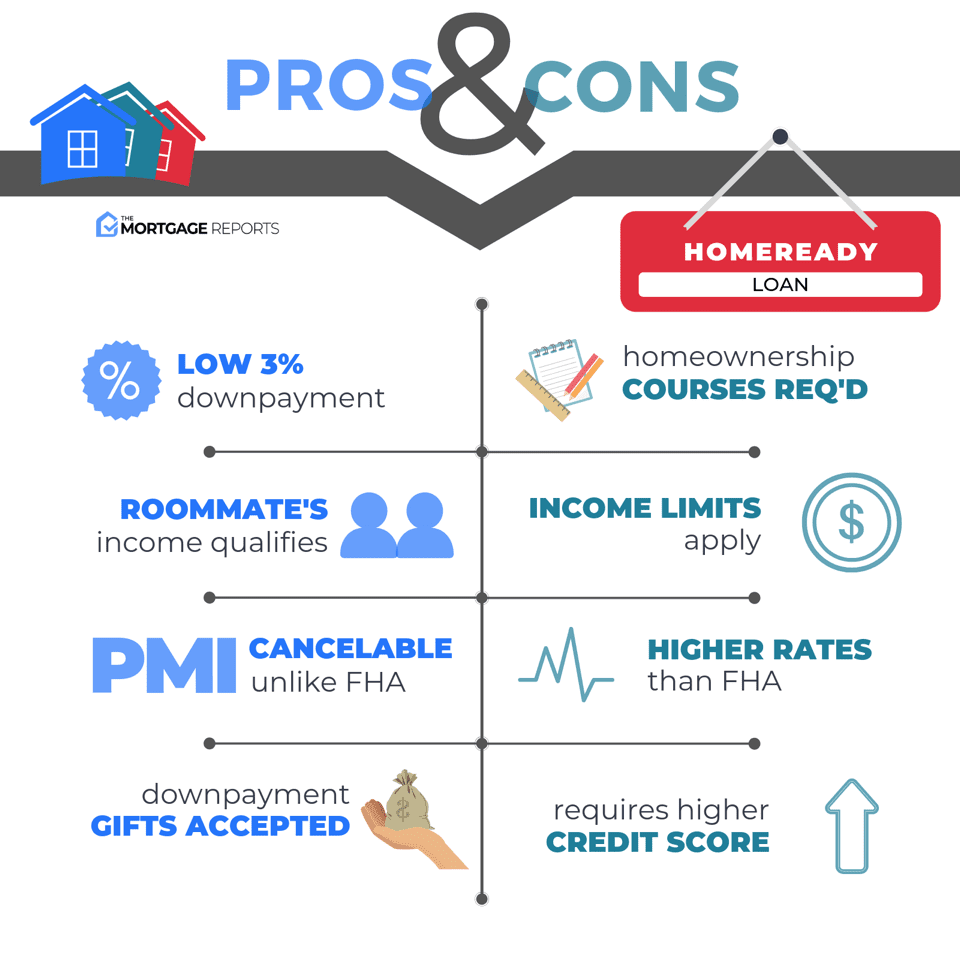

Several loan programs can help home buyers with a lower income and/or low down payment. One such program is the Fannie Mae HomeReady mortgage.

You could pay as little as 3% down on a HomeReady loan. That’s $6,000 down on a $200,000 home — even less than the FHA’s 3.5% down payment.

Plus you could use gifts, grants, or a down payment loan to help cover your upfront costs. And co-borrowers living in the home or outside of it can be on your application.

This makes HomeReady one of the easiest mortgage programs to qualify for.

In this article (Skip to…)

>Related: How to buy a house with $0 down: First-time home buyer

About The HomeReady Mortgage

Federal mortgage agency Fannie Mae launched the HomeReady program in December 2015. It’s now available through many major U.S. lenders.

Via the HomeReady loan, home shoppers with lower-than-average income for their area can get easier access to low-down-payment mortgages at today’s current rates.

This program allows a down payment of just 3%.

And as a unique benefit, HomeReady allows a variety of income sources to help your application.

You can apply with co-borrowers living in the home with you or living elsewhere (known as non-occupant co-borrowers). You can also count income from a renter or boarder on your application, as long as it’s properly documented.

For some families, these unique rules can mean the difference between getting approved for a loan and getting turned down.

Current homeowners can also use HomeReady for a refinance.

The program allows up to 97 percent loan-to-value (LTV) in some cases. That means you don’t need to wait until you have 20% equity to refinance into a lower interest rate and monthly payment.

Qualifying for a HomeReady Loan

To get a HomeReady loan, you’ll have to fall within the program’s income limits, take a short online class about homeownership, and have decent credit.

Exact requirements might vary by lender, but Fannie Mae sets the minimum requirements for all HomeReady loan applications.

Basic requirements for HomeReady include:

- You must not earn more than 80% of your Census tract’s median income. Check your area’s median income here

- You must agree to complete a 4-6 hour online homeownership education course

- You need a FICO score of at least 620 in most cases

- You need to use the home as your primary residence

- You need a debt-to-income ratio (DTI) no higher than 50%. This is more lenient than most other mortgage programs

If you meet these criteria, the HomeReady loan program may be just what you need to move from renting to homeownership.

HomeReady income limits

Fannie Mae sets income limits for its HomeReady program. To qualify, you can’t make more than 80% of your area’s median income (AMI).

That means if your area has a median yearly income of $100,000, you must make $80,000 or less to qualify for the HomeReady program.

Since HomeReady is intended for lower-income borrowers, these limits might not be a problem for most applicants.

But what if you’re worried your income is too low to qualify?

In that case, the HomeReady loan can help immensely.

HomeReady income source flexibility

Fannie Mae allows applicants to apply with one or more co-borrowers, as long as their combined income falls within the local HomeReady income limit.

You can also count income from a renter on your application, as long as they’ve lived with you for at least one year prior to buying the home.

Fannie Mae even allows lenders to consider the income of non-borrowing household members as a “compensating factor,” meaning it could help your chances if you have a higher DTI or lower credit score.

Just note that non-borrower income will not be counted directly toward your qualifying income. In addition, these policies can vary by lender, and consideration of non-borrower income may be rare.

Eligible property types

Borrowers have many options for buying real estate with a HomeReady loan.

You can purchase a traditional single-family home if you wish. But, if you want something a little different, Fannie Mae also allows the purchase of:

- Condominium units

- Homes in a planned unit development (PUD)

- Co-ops

- Manufactured homes

- Multifamily homes with 2, 3, or 4 units

Just note, borrowers who want a multi-unit home will need a higher credit score, possibly as high as 680.

No matter what type of home you buy with HomeReady, it needs to be your primary residence. That means if the building has 2-4 units, you must live in one of the units yourself full-time.

In other words, this loan program can’t be used to purchase investment properties or vacation homes. It’s intended for low and moderate-income buyers looking for a home to live in.

HomeReady mortgage interest rates

Interest rates for a HomeReady mortgage loan are the same as rates for a “traditional” loan. There is no premium applied for using the HomeReady program.

In fact, mortgage rates for the HomeReady loan might be even lower than for other low-down-payment mortgages — like the 3% down conventional 97 loan.

But, because mortgage rates can vary by as much as 50 basis points (0.50%) between lenders, it pays to shop around. Don’t stop shopping after you get your first quote.

Fixed-rate mortgage options

Borrowers using the HomeReady mortgage program have access to a complete mix of fixed-rate mortgage products, including:

- 10-year fixed-rate mortgage

- 15-year fixed-rate mortgage

- 20-year fixed-rate mortgage

- 30-year fixed-rate mortgage

This range of options is a big advantage over USDA loans, which offer only a 30-year mortgage.

Shorter-term loans often have lower interest rates than 30-year loans. Thanks to the low rate and short term, borrowers can save tens of thousands in mortgage interest over the life of the loan.

However, 10-, 15-, and 20-year loans generally have much higher monthly payments than 30-year mortgages. That’s because you have to pay off the same loan amount in a shorter amount of time.

For this reason, most home buyers choose a 30-year fixed-rate mortgage.

Adjustable-rate mortgage options

Borrowers using the HomeReady mortgage program also have access to a range of adjustable-rate mortgage (ARM) products. These include the:

- 5/1 ARM

- 7/1 ARM

- 10/1 ARM

Adjustable-rate loans have a fixed rate for the first 5, 7, or 10 years. After that, your interest rate and monthly payment could rise each year.

This makes ARMs much riskier than fixed-rate loans.

Some leading lenders have opted out of HomeReady ARMs. So if you want an adjustable-rate loan, you may have to shop around for a lender offering these.

Help with your HomeReady down payment

HomeReady’s 3% down payment is about half the average down payment size, and it’s a fraction of the 20% many renters think they’d need to save up.

Still, coming up with 3% — which is $6,000 for a $200,000 home — can be challenging for home shoppers who have limited income and/or savings.

HomeReady helps by allowing flexible sources for your down payment money. You could use:

- Gift funds — Family members could help you come up with your down payment by gifting the money. Note, this must be a true gift and not a loan in disguise. Learn more about down payment gift requirements here

- Home buyer grants — Ask your loan officer or real estate agent about down payment assistance programs in your area. Many local governments and nonprofits offer these

- Down payment loans — Fannie Mae’s Community Seconds program can help you secure a second loan specifically to cover your down payment and closing costs. Down payment assistance might offer a low- or no-interest loan as well

Using a second mortgage such as Community Seconds will put a second lien on your home which means you’d have to pay off both loans — your primary mortgage and your second mortgage — if you sell or refinance.

HomeReady loans vs. FHA loans

Like HomeReady loans, FHA loans help people overcome the financial challenges to homeownership.

If you qualify for HomeReady, you might also qualify for FHA. But which mortgage program is better?

Renters with limited cash for a down payment have used FHA loans since 1934. FHA’s minimum down payment amount is 3.5%, slightly higher than HomeReady’s 3%.

The down payments are similar, but these two loan programs have some big differences.

When is an FHA loan better than HomeReady?

FHA works best for borrowers with lower credit scores.

With a FICO as low as 580, you could borrow with only 3.5% down. (Borrowers with scores between 500-579 might still qualify, but they’d need at least a 10% down payment.)

Backing from the Federal Housing Administration helps lenders extend favorable loan terms to borrowers with lower credit scores.

By contrast, HomeReady depends more on the borrower’s credit, and you’d typically need a score of at least 620 to qualify.

FHA loans also work best for higher earners since the FHA program, unlike HomeReady, doesn’t have income limits.

When is HomeReady better than an FHA loan?

HomeReady loans offer more flexibility when it’s time for income verification.

For example, lower-income borrowers could apply with one or more co-borrowers.

You could even count supplemental income from a boarder’s rent if you plan to have a roommate or rent out a room in the house. The renter does not need to be included on your loan application, though you must document that they’ve lived with you for at least one year prior to applying.

Plus, since HomeReady is a conventional loan, you can cancel private mortgage insurance (PMI) once you’ve paid the loan down to 80% of the home’s price. This would lower your monthly mortgage payments considerably.

By comparison, FHA’s mortgage insurance coverage lasts the life of the loan unless you put 10% or more down.

Remember, though, you have to earn 80% or less than your area’s median income to qualify for HomeReady.

Fannie Mae HomeReady vs. Freddie Mac Home Possible

Freddie Mac’s Home Possible program works a lot like Fannie Mae’s HomeReady.

Like the HomeReady program, Freddie Mac’s Home Possible loan:

- Allows 3% down payment

- Has an income limit of 80% of the area median income

- Is co-borrower friendly

One of the biggest differences between these two programs is the minimum credit score. Many lenders require a credit score of at least 660 to qualify for a Home Possible loan. HomeReady, on the other hand, is typically available with a FICO score of 620 or higher.

Fannie Mae HomeReady FAQ

No, the HomeReady mortgage program can be used by first-time buyers and repeat buyers. However, you can’t get a HomeReady loan if you still owe money on more than one other home loan.

No, you do not need to have good credit to use HomeReady. You don’t even have to have average credit. The HomeReady mortgage program is available to buyers with credit scores starting at 620.

Yes, you can still use the HomeReady program if your credit score is non-existent. The program allows the use of non-traditional tradelines to establish credit history, including utility bills, cell phone or internet bills, gym memberships, and most other accounts which require a monthly payment.

Fannie Mae offers the HomeReady program via private mortgage lenders. In other words, you do not apply directly with Fannie Mae. Rather, you can apply with just about any mainstream mortgage lender. Most are authorized to do Fannie Mae loans. You can typically apply online, over the phone, or by walking into a local bank or lender’s office.

Fannie Mae has given all of its approved mortgage lenders authority to underwrite and approve HomeReady mortgages. Your lender may be opting out, and that’s okay. There are plenty of approved mortgage lenders who can help you. Call up a couple other lenders until you find one that does offer this program.

No. The MyCommunityMortgage (MCM) program was retired by Fannie Mae in late 2015. HomeReady is a newer mortgage program launched in December 2015. It’s not the same as a MyCommunityMortgage and, in some respects, HomeReady can be viewed as a replacement.

The HomeReady mortgage program requires a minimum down payment of 3%. If you purchase a $250,000 home, for example, you’d need at least $7,500 down to qualify for HomeReady.

Yes, your down payment on a HomeReady loan can be a cash gift from a relative, a spouse, a girlfriend or boyfriend, or a fiancé/fiancée. The money does not need to come from your own savings. Be sure your loan officer and real estate agent know you’ll be using gifted funds. And, make sure the funds are properly documented via a mortgage gift letter.

You are not required to bring any of your own money to closing with the HomeReady mortgage program. Your down payment can be gifted to you from a third party, and you can have the home seller pay for your closing costs using an option known as seller concessions. Typically, closing costs range from 2% to 5% of the loan amount, so be certain you discuss these costs with your real estate agent and loan officer before you go under contract to buy a home. And, you’d need to discuss any seller concessions prior to signing the contract.

Yes, the HomeReady program limits borrowers to a 50% debt-to-income ratio.

Yes, the HomeReady program requires borrowers to pay private mortgage insurance (PMI) when they borrow more than 80% of the home’s value. PMI cancels automatically once the loan reaches 78% LTV.

The HomeReady program features lower mortgage insurance costs than other conventional loans, including the other 3% down program, the conventional 97. Exact PMI costs depend on your credit score and down payment. Your loan officer can tell you how much PMI will cost on your HomeReady loan once you’ve completed an application.

The HomeReady program features lower mortgage insurance costs than other conventional loans, including the other 3% down program, the conventional 97. Exact PMI costs depend on your credit score and down payment. Your loan officer can tell you how much PMI will cost on your HomeReady loan once you’ve completed an application.

HomeReady is a conventional mortgage loan via Fannie Mae, which means that you are required to pay private mortgage insurance until your home’s loan-to-value (LTV) reaches 80% of the original purchase price, or 80% of the home’s market value.

Yes, you can use the HomeReady program to refinance your existing home, including a limited cash out refinance (LCIR). One benefit of refinancing with HomeReady is that you only need 3% equity in the home to qualify (meaning the max LTV is 97 percent). Some other refinance programs require at least 20% equity, or a maximum loan-to-value of 80 percent.

Yes, the HomeReady program allows a borrower to use boarder income to help get qualified. That includes rental income from accessory dwelling units. Boarders must have a 12-month history of living with you and contributing income. Documentation of all 12 months is not always required.

If you want to count another person’s income toward your qualifying income for HomeReady, they need to be a co-borrower on your application. Non-borrower income may be considered as a ‘compensating factor,’ but that only means it could help your chances of qualifying if your application has some weaker points. That income will not be directly used to determine your eligibility or loan amount.

No, the HomeReady program does not limit the number of relatives living in one home, nor the number of relatives whose income is used to help qualify for the program.

No. However, non-borrowing relatives must have legal documents to show their immigration status — a green card, work visa, etc.

No. Borrowers must meet income guidelines to qualify. Originally, HomeReady worked for all borrowers in low-income census tracts, but Fannie Mae revised the program in 2019 to remove that feature. Now, all home buyers using HomeReady must meet income eligibility requirements.

Yes, homeowner counseling is required with the HomeReady program. The online course, called Framework, can be completed in 4-6 hours on your smartphone.

Yes, you can use the certificate from your previous homeowner counseling course as part of your HomeReady mortgage application, so long as the course was completed within the last six months.

Yes. You can own other residential properties and still get a HomeReady loan, assuming you plan to make the new home your primary residence. However, you can’t use HomeReady if you still owe money on more than one other property loan. Co-borrowers who don’t plan to live in the home can owe money on more than one additional property.

What are today’s HomeReady mortgage rates?

The HomeReady mortgage program is designed to help more U.S. households get approved for low-down payment loans. Qualified borrowers can buy with just 3% down.

Ready to get started? Check your eligibility with a lender today.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.