Conventional loan rates and requirements for 2022

Guide to conventional loans

When most people think of a mortgage, they’re thinking of a conventional loan.

Conventional loans are the closest you can get to a ‘standard’ mortgage. There are no special eligibility requirements, pretty much all lenders offer them, and you can qualify with just 3% down and a 620 credit score.

Thanks to their low rates and wide availability, conventional loans are the most popular mortgage for home buying and refinancing.

This conventional loan information is accurate as of today, March 8, 2022.

In this article (Skip to…)

What is a conventional loan?

Broadly, a conventional loan is any mortgage not backed by the federal government. Most conventional loans also fall into the category of ‘conforming loans.’ These are mortgages that meet lending standards set by Fannie Mae and Freddie Mac.

Although they’re regulated by Fannie and Freddie, conventional loans are actually offered by private lenders. You can get one from just about any bank, mortgage lender, or mortgage broker.

Most U.S. mortgages are conventional loans. And if you’re buying a home, there’s a good chance this is the type of loan you’ll use. So here’s what you should know about them.

Conventional loan requirements

Conventional loan requirements vary by lender. But most conventional loans have to meet basic guidelines set by Fannie Mae and Freddie Mac. These include:

- A minimum credit score of 620

- A debt–to–income ratio lower than 43% (can be higher, depending on qualifying factors)

- A down payment of at least a 3%

The conventional loan amount also has to be within conforming loan limits: up to $ in most areas, but more in some high–cost areas. These are reevaluated by the Federal Housing Finance Agency (FHFA) every year.

You can check conventional loan limits in your area using this search tool.

Minimum down payment for a conventional loan

It’s a common myth that you need a 20% down payment for a conventional loan. You can actually get one with as little as 3% down.

All told, there are six major conventional loan options that can range from 3% to 20% down.

Conventional loan down payment requirements:

- Conventional 97 loan: 3% down

- Fannie Mae HomeReady: 3% down

- Freddie Mac Home Possible: 3% down

- Conventional loan with PMI: 5% to 19.99% down

- Piggyback loan (no PMI): 10% down

- Conventional loan with no PMI: 20% down

From the 10% down piggyback loan to 3% down HomeReady and Conventional 97 loans, low–down–payment options not only exist but are extremely popular with today’s conventional loan borrowers.

So, how do you qualify for a conventional loan? Simply by meeting requirements set out by Fannie Mae and Freddie Mac.

Once you do that, you can join the club of conventional loan homeowners who make up the majority of the market.

The 20% down payment myth

Where does the myth about the 20% down payment requirement come from? Probably from shoppers who want to avoid paying private mortgage insurance premiums.

When you put less than 20% down on a conventional loan, your lender will require private mortgage insurance (PMI). This coverage helps protect the lender if you default on the loan.

PMI does increase monthly mortgage payments. But that’s OK if it allows you to get a conventional loan with a down payment you can afford.

Also note that conventional PMI can be canceled later on, once your home reaches at least 20% equity. So you’re not stuck with it forever.

Conventional loan rates

Conventional loans come with low rates that make home buying affordable.

Today’s average rate for a conventional loan starts at % (% APR) for a 30–year, fixed–rate mortgage, according to our lender network.

For a 15–year conventional loan, the average rate drops to % (% APR).

Today’s conventional loan rates (March 8, 2022)

| Loan type | Average Interest Rate* | APR* |

| Conventional 30-Year FRM | % | % |

| Conventional 15-Year FRM | % | % |

*Average rates reported daily by TheMortgageReports.com lender network. Your own interest rate will be different. See our full loan assumptions here.

Conventional loan rates are heavily based on the applicant’s credit score – more so than rates for FHA loans.

For instance, a home buyer with a 740 score and 20% down will be offered about a 0.50% lower rate than a buyer with a 640 score.

Rates are also based on mortgage–backed securities (MBS) which are traded just like stocks. And like stocks, conventional loan rates change daily, and throughout the day.

Shop around with at least three different lenders

When you’re shopping for a mortgage, it’s important to get personalized rate quotes.

Published rate averages are often based on the perfect applicant – one with great credit and a large down payment. Your rate might be higher or lower.

It pays to get at least three written quotes from different lenders, no matter which loan term or loan type you choose. According to one government study, applicants who shopped around receive rates up to 0.50% lower than non–shopping.

Get a conventional rate quote based on your information – not on the information of an average buyer.

How do you qualify for a conventional loan?

A lot of home shoppers think it’s too hard to qualify for a conventional mortgage, especially if their financial situations aren’t perfect. But that’s not really the case.

Just like with a government–backed loan, qualifying for a conventional loan requires you to prove:

- You make enough money to cover monthly payments

- Your income is expected to continue

- You have funds to cover the required down payment

- You have a good credit history and decent score

True, the standards to qualify for a conventional loan are slightly higher than for an FHA or VA loan. But they’re still flexible enough that most homebuyers are able to qualify.

Credit score requirements

According to loan software company Black Knight, the average credit score for all applicants who successfully complete a mortgage is around 744. This is plenty high to get approved for a conventional loan.

The minimum credit score required for most conventional loans is just 620.

“We want to know that people pay their bills on time and are financially disciplined and good at money management,” says Staci Titsworth, regional vice president sales manager with PNC Mortgage in Pittsburgh, PA.

A slightly lower credit score may pass the credit score test, but the lender will typically charge a higher interest rate to compensate for the greater risk.

Applicants with lower credit may want to choose an FHA loan, which does not charge extra fees or higher rates for lower credit scores.

Be sure to check your credit report before applying for a mortgage so you’ll know where you stand.

Employment and income requirements

During the mortgage application process, home buyers must provide proof of earnings, which may involve some or all of the following documentation:

- 30 day’s pay stubs

- 2 year’s W2s

- 2 year’s tax returns if self–employed

- An offer letter, if not yet started

- Proof of education for new graduates

“Most lenders require two–year documentation to show a consistent earnings stream,” Titsworth says.

Alimony can also be counted if documented in a divorce decree, along with the recurring method of payment such as an automatic deposit.

Seasonal income is also accepted with proof in a tax return.

Property requirements

A lender won’t approve a mortgage for an amount that’s greater than the value of the home. Before closing on the loan, the lender will appraise the property to determine its fair market value.

- As an example, let’s say the buyer has agreed to pay $200,000 for a home but the appraisal comes in at $190,000

- In this case, the home buyer should use this appraisal as a bargaining chip to get the seller to lower the price to a level the lender will finance

- Or, the buyer could pay the additional $10,000 out of pocket to compensate for the lower borrowing limit. This $10,000 would be added to the down payment you’d already agreed to pay

Property value isn’t the only thing to watch for when getting a conventional loan appraisal.

Sometimes during an inspection, the appraiser may require another professional’s opinion.

“If the appraiser sees water stains or a lot of leaky faucets, he may request a plumbing inspection. The seller may need to make improvements, which could delay a closing,” Titsworth says.

However, conventional loans actually come with less strict appraisal and property requirements than FHA, VA, or USDA loans.

This is another advantage to conventional: You can qualify for a home in slightly worse condition and plan to make the repairs after your loan is approved and you move in.

Conventional loan limits

Nationwide conventional loan limits start at $ and go higher in many locations.

For instance, Fannie Mae and Freddie Mac allow a loan amount up to $ in certain high–priced ZIP codes.

Home buyers who need a loan amount above the standard limit should check for the specific limit for their area.

Loans in excess of an area’s conventional loan limits are considered non–conforming loans.

These require a jumbo loan instead of a conventional loan

Debt–to–income ratio

The buyer’s debt–to–income ratio (DTI) also plays a factor in conventional loan qualifying.

DTI compares your total monthly debts (including mortgage costs) to your gross income. This number is used to determine how large a mortgage payment will fit within your monthly budget.

Many lenders want this ratio to be less or equal to 36% of the borrower’s income.However, conventional loans may allow a DTI as high as 43%.

To find your debt–to–income ratio, add up your loan payments, including:

- Student loans

- Personal loans

- Car loans

- Credit card minimum payments

- Your projected mortgage payment

Also add in any child support or alimony payments you’re required to make each month.

Then divide this sum by your monthly gross (pre–tax) income.

Closing costs

Closing costs will include fees such as a lender’s origination fee plus vendor fees like the appraisal, title insurance, and credit reporting fees, says Titsworth.

Sometimes, a lender or seller will pay all or some of these expenses depending on the strength of the market and desire to close the transaction.

Check whether your chosen lender offers lender credits, and make sure any seller contributions are within Fannie Mae and Freddie Mac guidelines.

Typically, sellers and other interested parties can contribute the following amounts, based on the home price and down payment amount.

- Less than 10% down: 3% of the purchase price

- 10 to 25% down: 6% of the purchase price

- More than 25%: 9% of the purchase price

With a rental or investment property, the seller can contribute only 2% of the purchase price toward closing costs.

Benefits of a conventional home loan

Conventional loans are the most popular type of mortgage. After that come government–backed mortgages, including FHA, VA, and USDA loans.

Government–backed mortgages have some unique benefits, including small down payments and flexible credit guidelines. First–time home buyers often need this kind of leeway.

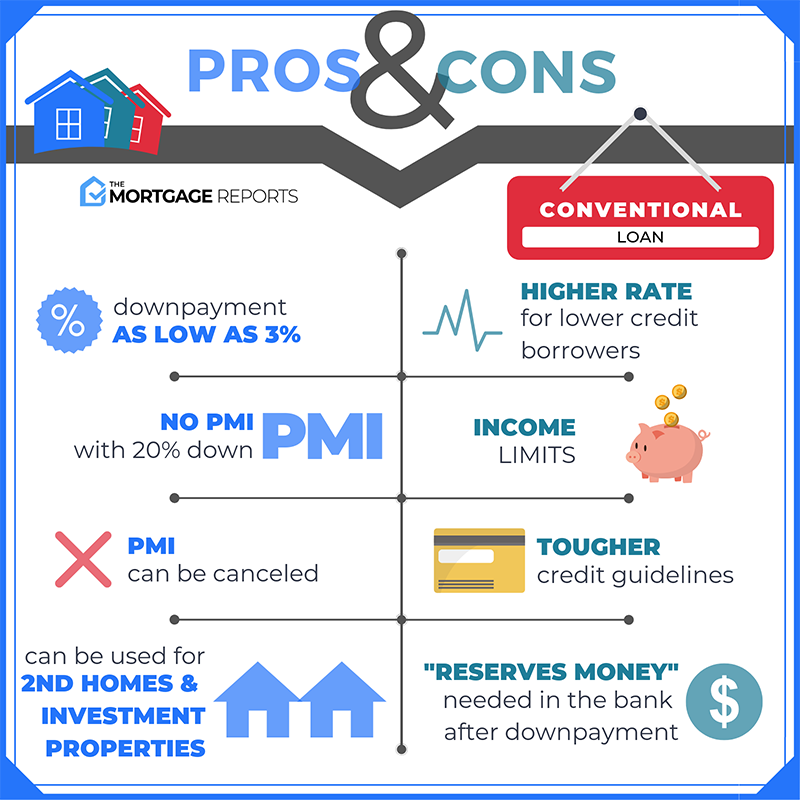

But conventional loans can outshine government–backed loans in several ways.

1. Flexible repayment plans

As with most mortgages, conventional loans offer several repayment options.

Conventional loans come in 10, 15, 20, 25, and 30–year terms. Some lenders even let you choose your own loan term, for instance, between 8 and 30 years.

The shorter your loan term, the lower your interest rate should be. But your monthly payment will be higher because you’re paying off the same loan amount in a shorter time.

Fortunately, a 30–year fixed–rate conventional loan still comes with low fixed–interest payments that are accessible to the majority of home buyers and refinancers.

2. Adjustable rates available

Conventional loans are also a smart choice for those who know they won’t remain in their house long and want a shorter–term, adjustable–rate mortgage. This option comes with a lower interest rate than that of a fixed–rate loan.

Adjustable rates are in fact fixed, but only for a period of time – usually 3, 5, or 7 years. During that initial fixed–rate period, the homeowner pays ultra–low interest and can save thousands.

Today’s home buyers often choose a 5–year ARM or 7–year ARM. These loans can provide thousands in savings while giving the home buyer enough time to refinance into a fixed–rate loan, sell the home, or pay off the mortgage entirely.

But after this low introductory rate expires, the loan’s interest rate – and its monthly mortgage payment – could decrease or increase each year, depending on market conditions.

This makes ARM loans inherently risky for homeowners, and an option that should be considered very carefully.

3. No upfront mortgage insurance fee

Conventional loans do not require an upfront mortgage insurance fee, even if the buyer puts less than 20% down.

FHA loans, USDA mortgages, and even VA loans require an upfront insurance fee, usually between 1% and 4% of the loan amount.

Conventional loans only require a monthly mortgage insurance premium, and only when the homeowner puts down less than 20%.

Plus, conventional mortgage insurance may be lower than that of government loans if you have good credit and a decent down payment.

About conventional loan down payments and PMI

The amount of the borrower’s down payment can affect the interest rate and final loan costs.

Putting down a larger amount means monthly mortgage costs will be lower.

A down payment of at least 20% will also eliminate conventional mortgage insurance. By contrast, FHA and USDA loans require mortgage insurance regardless of how much money you put down.

7 low–down–payment conventional loans

| Loan Type | Requirements |

| 5% down with PMI (Conventional 95) | One loan at 95% loan-to-value. PMI required. |

| Conventional 97 | 3% down. No income limits. |

| HomeReady or Home Possible | 3% down. Must be at or below the geographical area’s median income unless home is located in underserved area. |

| 90% loan | One loan with 10% down. PMI required. |

| Piggyback 80/10/10 | 10% down, 10% second mortgage, and 80% conventional loan. No PMI required |

| Down payment gift | Applicant may receive any percentage of the down payment as a gift from family or other eligible source. |

Conventional loans with just 3% down

Many conventional loans are made with as little as 3% down.

The HomeReady mortgage program is one such option. It allows non–borrowing members of the household to help the loan applicant get approved.

Lenders will consider the income of mothers, fathers, extended family, and non–married partners – even when they are not officially on the loan file.

The Conventional 97, as the name suggests, allows home buyers to borrow 97% of the home’s price. Unlike the HomeReady option, these loans are available to applicants at any income level buying a home in any location.

The drawback to a 3% down loan? The interest rate may be higher to compensate for the smaller amount down.

Mortgage insurance may be more expensive as well, as compared to a 5% or 10% down conventional loan.

Avoid PMI with an 80/10/10 loan

The piggyback 80/10/10 loan option lets the applicant skip the full 20% down payment and skip the mortgage insurance.

How? The applicant applies for a first mortgage for 80% of the purchase price. Simultaneously, he or she opens a second mortgage, such as a home equity line of credit (HELOC) for 10% of the purchase price.

Then, only 10% down in cash is required because the lender allows the borrowed 10% loan to count toward the applicant’s down payment.

Together, the second mortgage and the cash total 20% down, eliminating the need for mortgage insurance premiums.

Sourcing your down payment

A conventional loan borrower has the option to put anywhere from 3% to 20% down or more.

Plus, a down payment gift can cover the entire amount in some cases. Check with your loan officer for gift and donor documentation requirements.

Unless it’s a gift, the applicant will need to verify a valid source of the down payment such as a savings or checking account.

Applicants can liquidate investment accounts and even use a 401k loan for the down payment.

Typically, home buyers will need to supply a 60–day history for any account from which down payment funds are taken.

Private mortgage insurance (PMI)

Private mortgage insurance, or PMI, is required for any conventional loan with less than a 20% down payment.

PMI rates vary considerably based on credit score and down payment.

For instance, one PMI company is quoting the following rates, as of the time of this writing, for a $250,000 loan amount and 5% down:

- 740 credit score: $123 per month

- 660 credit score: $295 per month

And these are quotes for a 10% down payment:

- 740 credit score: $85 per month

- 660 credit score: $208 per month

Higher mortgage insurance premiums for borrowers with lower credit scores prompt many buyers to use an FHA loan.

Unlike conventional loans, FHA loans do not charge higher mortgage insurance rates, even for applicants with very low scores.

Another factor that might affect your PMI rate: the mortgage insurance company itself.

Your lender usually chooses your PMI company, and different companies may charge different rates. However, you do have some say in the choice. If you know a particular PMI company that offers the best deal, ask if your lender works with them.

If not, the lender may be able to provide a similar offer from a different PMI provider, or you can choose a lender that works with your chosen mortgage insurance company.

Conventional loan alternatives

Conventional loans are the least restrictive of all loan types. There’s a lot of flexibility around the down payment, eligibility guidelines, and types of property you can buy with conventional financing.

However, there are government–backed home loans that are designed to help people achieve their goals of homeownership when a conventional loan may not be the best mortgage program available to them.

Keep in mind these government–backed mortgages have specific purposes and come with a variety of limitations:

- USDA loans are guaranteed by the U.S. Department of Agriculture. These loans are only available in designated rural areas. For those who qualify, USDA loans allow zero down payment and have low interest rates on average

- VA loans are backed by the Department of Veterans Affairs and are available only to current and former military service members. They offer a lot of benefits, like zero down payment and no monthly mortgage insurance. But they are not available to the general population

- FHA loans are guaranteed by the Federal Housing Administration. These loans are a powerful home buying tool, but they come with high mortgage insurance fees that are required for the life of the loan – up to 30 years. The only way to cancel FHA mortgage insurance is to refinance out of the FHA loan, which would require paying closing costs again

Additionally, most loan programs provided by the federal government can’t be used for second homes or investment properties. They’re designed to help Americans buy single–family homes to be used as a primary residence.

First–time and repeat buyers can land a good value when they choose a conventional loan for their home purchase.

And, more buyers qualify for this loan than you might expect.

Conventional loan vs. government loans

Home buyers have dozens of mortgage loan options today.

In general, though, mortgages can be divided into two broad categories – government–backed loans and conventional loans.

The rule of thumb is that if you have good credit (680+) and a large down payment (5% or more), a conventional loan is often best. If you have lower credit and/or a smaller down payment, a government–loan can help.

But those are not universal rules. The best type of mortgage for you will depend on your budget, your credit, and your home buying goals.

To help guide you in the right direction, here’s a broad overview of conventional vs. government loans, and who they’re best for:

- Conventional loans: Privately–backed loans that tend to be most affordable for people with credit scores above 680 and down payments of 5% or more. However, conventional loans are also available with credit as low as 620 and a down payment as low as 3%

- Jumbo loans: Jumbo loans may be the right option for people buying high–priced homes. That includes any loan amount above $[conventional_loan_limits] in most areas. You typically need a credit score of 700 or higher for a jumbo loan

- FHA loans: FHA loans are typically best for people with credit between 580–680 and a down payment of at least 3.5%

- VA loans: VA loans are almost always best for qualified veterans and military members. They let you buy a house with 0% down, exceptionally low interest rates, and no monthly mortgage insurance

- USDA loans: These zero–down loans are available in select rural and suburban areas. They’re reserved for home buyers with low– to moderate–income, and typically have below–market interest rates

If you’re not sure which type of loan is best for you, read up on your options or chat with a loan officer about what you might qualify for.

Check your conventional loan eligibility

The bottom line is that it’s very important for home buyers to shop around for a conventional mortgage with at least three lenders.

Today’s rates are low and can be even lower with the right shopping practices.

Check your conventional loan eligibility and rates today.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Comments are closed.